Let’s Get Ready For

The Greatest Commodity

BULL MARKET Of Our Lifetime!

The Greatest Commodity

BULL MARKET Of Our Lifetime!

What's Ahead Has Been Decades-in-the-Making

What's happening right now in the Commodity Markets is RARE.

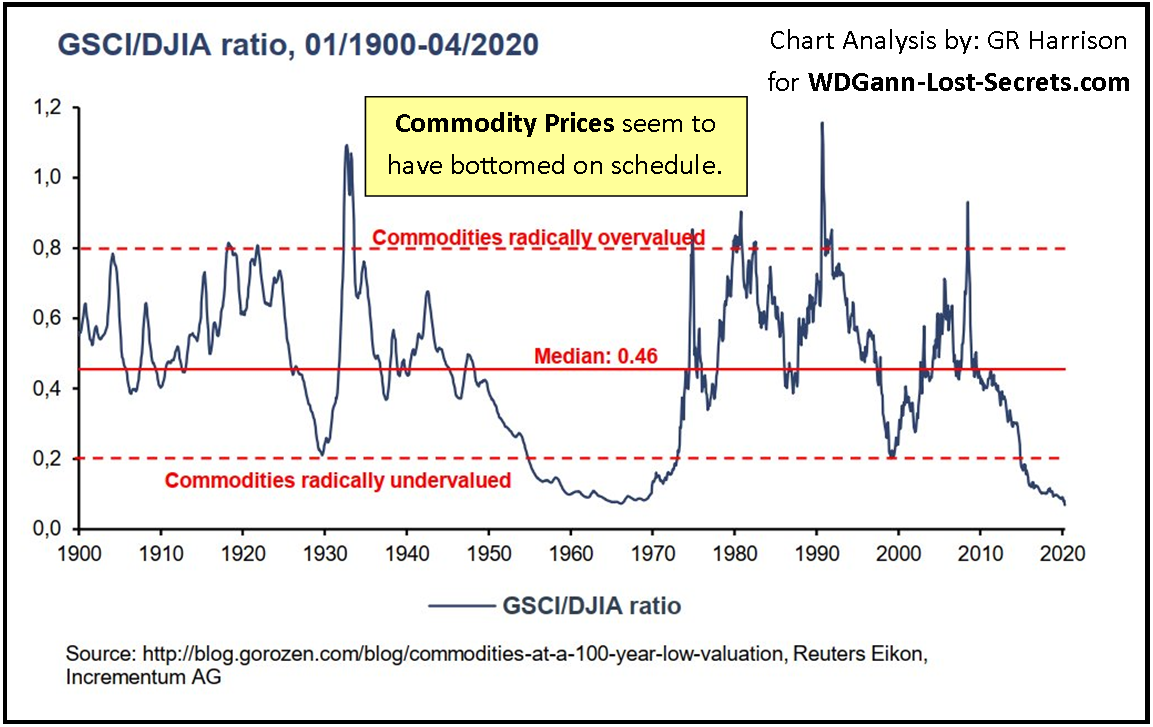

It's a Special Time when prices relative to the Stock Market are Low. Extremely Low. In fact, you could say this is a time when commodities are radically undervalued.

The point is, that the convergence of events and markets to create this type of imbalance in the value-structure, only comes around every 25-30 Years or so.

RARE, yes, but, when it finally does arrive this time, Fortunes will be made by Wise Investors that will grow more rapidly than the imagination can easily envision.

Learn From The Chart Above, . . . And, Be Ready to Act!

You'll note on the above chart that this Index comparison of Commodities vs. the Stock Market goes back over 120-Years.

For the last several Years, this index has dropped down into the undervalued area signifying a good value area to Buy Commodities.

This kind of general information is adequate for those who choose to hold non-perishable Metals or who don't mind locking up their CASH for what may be some time to come. But, for traders who wish to work the Markets, more precision of timing is needed in order to reduce Risk.

But, as you see, this chart can give us only general information. It can't give us the correct timing for the actual turn upwards expected for the next Bull Market, (which WILL come, at some point, and, which may have actually already started!),

Earlier versions of this chart had people jumping into the commodity markets years too early only to see the index decline even further with no turn in sight. As with all Markets at their extremes, Commodities went LOWER than imagined possible and Stocks went HIGHER than anyone could possibly imagine as well. Both of these factors led to a continued decline in the Index line on the chart.

Those who were caught by these extreme events didn't recognize the limitations of this indicator chart.

A seriously focused Investor needs to have time tested Techniques that can detect turns like this early enough to be profitable out-of-the-gate.

As an aside, we have just those type of Unique and Time-tested Trading Methods available in our Academy Collection for the discerning trader who wants to be prepared & ready for what is coming financially.

You'll find references to them all over this website, or, you can email me by CLICKING HERE and ask for our Latest WINTER SPECIAL CATALOG or the donation request level for the Course or Courses of most interest to you and your trading plans.

The Above Chart Is Nice, But, Where Are We TODAY??

I've taken the above chart concept and updated it for you below . . .

Here we can more clearly see that general commodity prices vs. stocks bottomed in 2020, or, seem to have bottomed.

we're still monitoring the retracement move, but, if the index rises above the circled region shown on the chart, then, I'd interpret that as a signal to move to the LONG side in a serious manner!

This will also likely signal the END of the current Stock Market Upside Trend we've been in for many, many years now.

That Event will be a seriously disturbing one for most of the uninformed masses of investors. Clearly, the best defense will be to switch out of Stocks and into the Commodity Markets as soon as this signal is given and before the Institutions Panic, which they WILL DO, (they always do Historically).

There are other Cycles converging in our time period as well, but, this would be an important one to monitor. A sudden drop in the Stock Market will propel this index upwards quickly and the break-out will be under way.

Moves like these generally last YEARS not Weeks, and, our article on Inflation previous to this one show that soon everyone will KNOW that Inflation has arrived and Commodity Prices rising will also propel this Index Higher.

At times like these in History, Stock Markets Peak & Crash while Commodities Rise. One rising trend in Stocks is replaced by a new rising one in the Commodity Markets instead.

However, there have been exceptions or delays in these two events, like the peak in Stocks in 1929 but the bottom of Commodities coming not until 1932 a few years later.

Here yet again, one needs to use a method that can discern these separate trends so as not to act too early or too late.

Here again, the first chart can only guess these years in a general way.

You'll need the kind of precise methods that have already been tested on such market turns in History to be your best guide to timing the Turns in Trend.

All of our Courses have been tested successfully on charts from Historically critical periods of extreme Highs and Lows. If they can't survive these points in History, then, I don't release them!

Once Again, Let History Be Your Reliable Guide

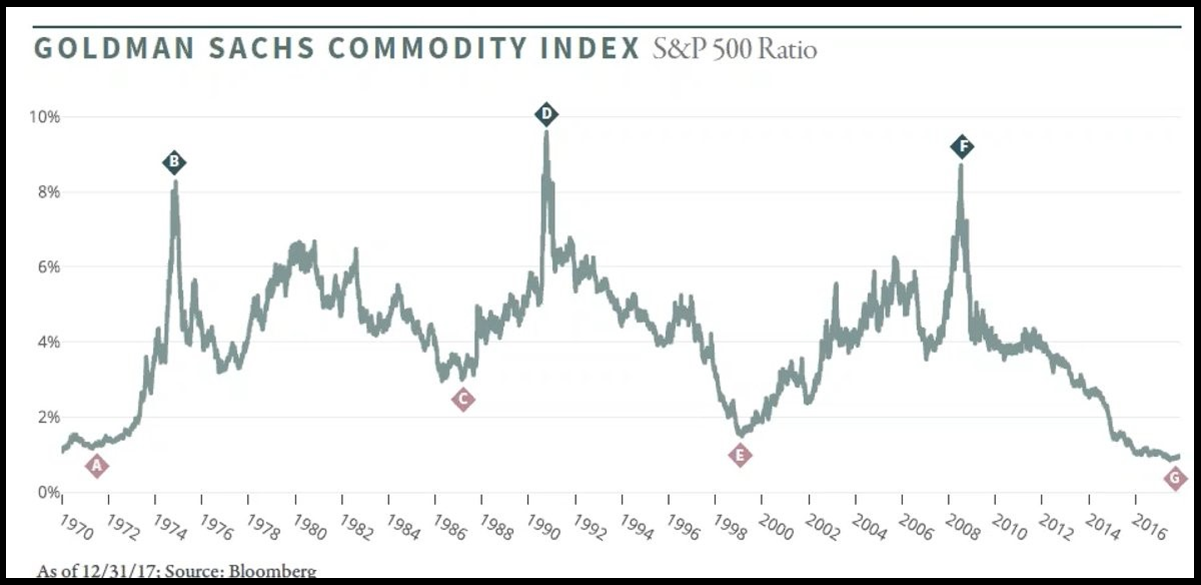

Let's take a longer-term look at these important Commodity Cycles . . .

Inflation is already in the News. and, certainly on people's minds more than for many years. It'll soon be on everyone's lips as prices rise still higher.

This Bull Market is one to look forward to.

In a World of mostly negative, fear-mongering and mindless babble, here's something to latch onto and hang on to for the most profitable ride of your Life!!

Join me and our merry band of students/clients as we go forth to profit from one of the Greatest BULL Market moves of the coming decade. - George