The S&P 500 Stock Index:

Be Aware Of A Hidden

Distortion of Proportion!

Be Aware Of A Hidden

Distortion of Proportion!

This Index No Longer Represents the 'Market'!

This S&P 500 Price Chart Looks Great Doesn't It?

What's not to like? This Market has been sailing upwards for over a Decade now. No end is in sight. Or, so it might seem.

But, is the S&P 500 Stock Index still measuring the same things that it was back in 2010?

What do I mean by that?

This . . .

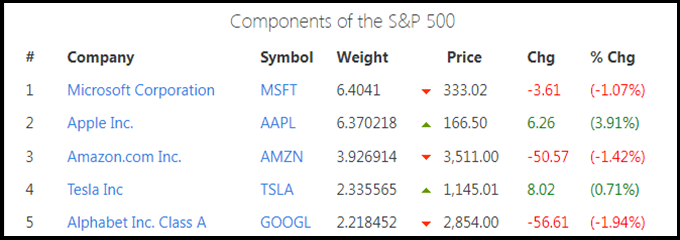

Just 5 Stocks, . . . Are Over 20% Of This Stock Indexes Value!

That's right! The five largest traded Stocks have over one-fifth of the valuation of the entire 500 corporations that make up the S&P 500 Index.

Yes, the usual "suspects' of MSFT, AAPL, AMZN, TSLA and GOOGL are hogging the 'show' and pushing the market ever higher.

Seems hard to believe, but, it's true as the following graphic shows . . .

If you tally up the 'Weight' aspect you'll find that these 5 very famous and popular stocks have a portion of the entire index that is way out of proportion to what most folks would assume.

At times, this proportion has gone over 25%!

What's The Bottom Line?

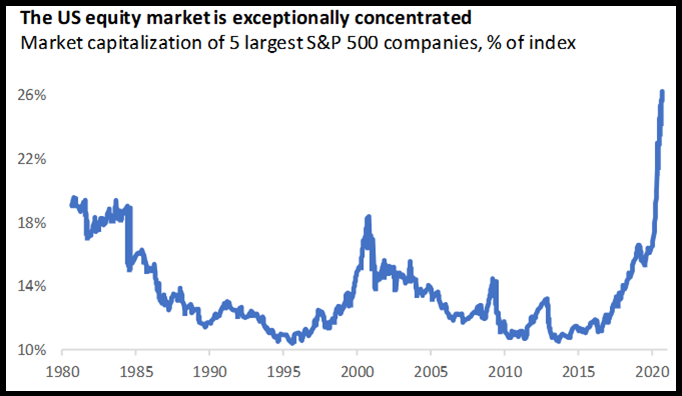

There's an exteme concentration of the Wealth of the entire Stock Market wrapped up in just a few stocks.

This can pose a problem in analysis as, if it should happen that, the other 495 companies should weaken in price trend one wouldn't see it reflected in the overall index average as long as big money keeps pumping up the top few stocks of the index.

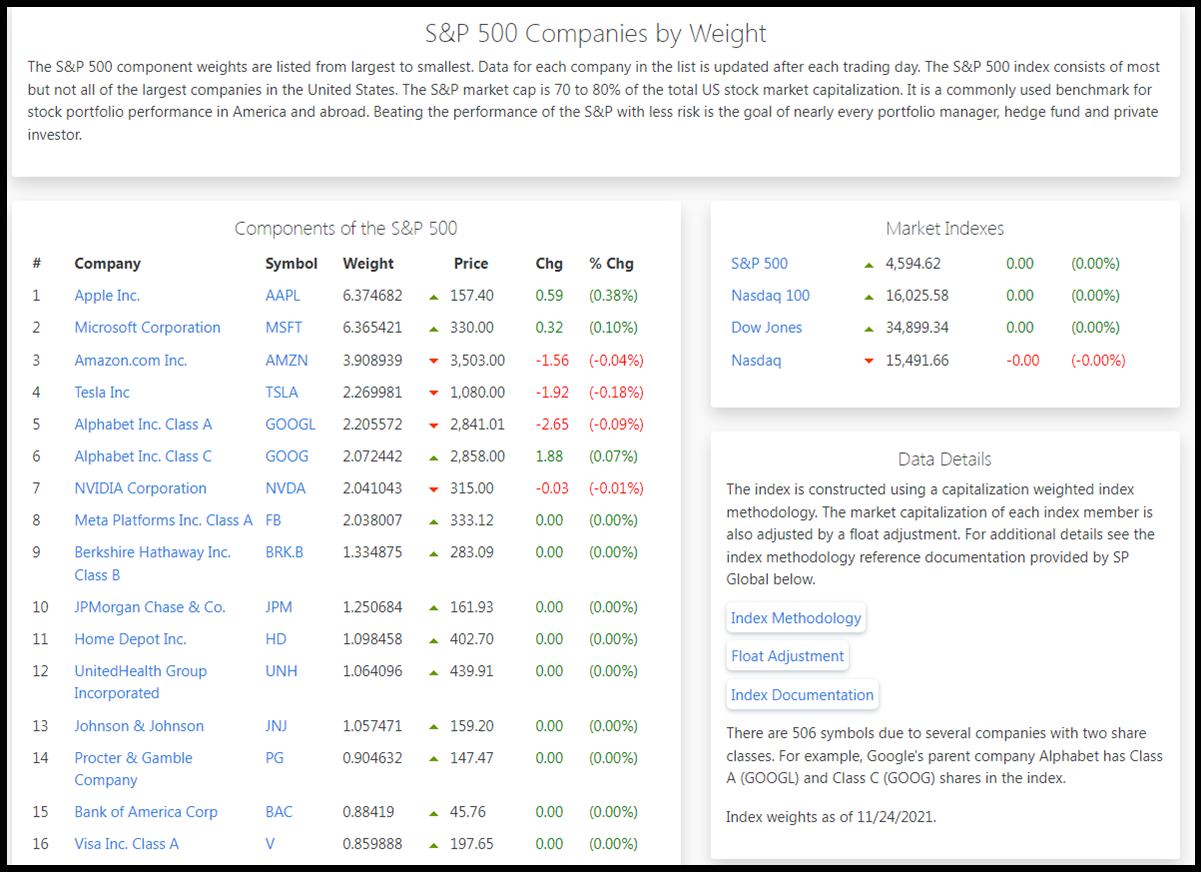

In fact, if one tallys up the top 15 stocks of this index, they'll find that over one-third of the stock market's valuation is represented by only these 15-stocks alone!

It seems clear that this is a 'top-heavy' market, meaning, that only a few 'top' stocks are keeping the whole show going.

Here's The Proof Of Those Numbers . . .

observe the longer list of components of the S&P 500 below . . .

The basic facts of the price charts for the S&P 500 aren't altered. The signals for a change in trend, when it comes, will still be evident.

However, what I'm pointing out here is that it's likely that earlier notice of the big change in trend will be found by monitoring the 'less glamorous' stocks, (the other 485 companies that aren't the 'shining stars' that everyone else is looking at).

Because of the way that this index is designed, a potential distortion of importantce is being attributed to the entire index that it doesn't deserve.

Much like the Magician who misdirects your attention to his left hand, (while he performs his trick with the right), you would do well not to fall for this illusion when it comes to this market and your long-term portfolio holdings.

Watch the other indexes, especially the broader ones with a larger size, for a hint of weakness not reflected in the big S&P 500 index.

It's always a good idea not to get too focused on a single market anyways.

It's better to keep things in context of the larger 'Whole'. - George