Crude Oil Down Trend Continues

CRUDE OIL TRENDS DOWNWARDS AGAIN

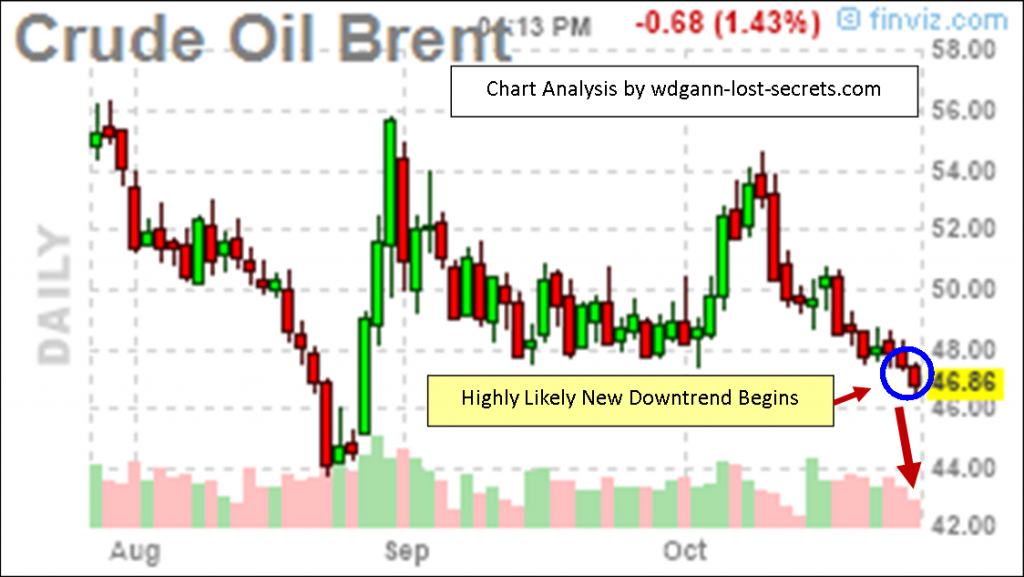

Although the shift took place a couple of trading days back, the market has now confirmed that it’s breaking downwards again in trend.

Here’s what it looks like on a price chart with annotations on where the confirmation took place.

Here’s what it looks like on a price chart with annotations on where the confirmation took place.

This time down, we may take out the August lows and that support level needs to be given a good deal of weight.

If the trend carries through, then, we should see some price support at the $43-$44 level.

The present price angle of descent is below 45 degrees further signifying a weak market and a lack of buying support at present.

At this point price would have to go above the $52 level to assume a more bullish trend again.

Below you’ll find a lower-cost way to follow the Crude Oil Market by using the ETF symbol USO or it’s options:– George

S&P 500 Pivot Point

STOCK MARKET AT IMPORTANT PIVOT POINT

The Stock Market is now at an important pivot point in price.

As described in my post from some months back (see the August 29th post), the ‘unimaginable’ event (a rising stock market which hardly anyone proposed at that time) has, not only occurred, but, is now on the verge of accelerating even higher and faster.

Despite all the doom and gloom among the average investors (and actually, because of it), the big money has positioned themselves for the unexpected; a strong upwards price movement with absolutely no fundamentals to justify it in the minds of ‘logical’ investors.

Despite all the doom and gloom among the average investors (and actually, because of it), the big money has positioned themselves for the unexpected; a strong upwards price movement with absolutely no fundamentals to justify it in the minds of ‘logical’ investors.

Of course, logic left this market scene long ago, but most still believe it to be there and that ‘logic’ would never lead to expectations of a higher market.

Most investors have been standing with their mouths open and eyes fixed like a deer in the headlights gazing at the impossibility of it all and shaking their heads as prices keep moving higher.

‘Haven’t they been reading the News?’

Not to worry though.

There’s still a chance that this market will weaken and come back down but that all depends now on what the market does next now that it has encountered this particular price level on Friday’s close.

As the chart I’ve provided here shows with the blue circled price candle; we’re now at an important price point for this important market indicator.

Should prices break upwards and maintain that upwards bias during the day Monday in the US Market hours, then, we’re very likely to see the beginnings of a very strong price campaign upwards in price.

Forget the news. It’s irrelevant in these market conditions. We’re reading the signs of the market itself here and news is a lagging indicator at best in this market.

As mentioned earlier, if prices can’t break out above Friday’s high, then, a new price slide will emerge.

The downside is not the way to bet this time though, and, this is a lower-risk point from which to stake one’s price direction preference. – George

Selected GOLD Trade Successful

The Selected Gold Trade for Oct. 8th was Successful.

Our Report released late on the 7th of October yielded +$750 in potential returns based on the parameters of the report and the stop recommended.

It was an interesting, short-term trade which has since reversed right from our Stop point to go higher by another $1,500 per contract.

It was an interesting, short-term trade which has since reversed right from our Stop point to go higher by another $1,500 per contract.

The process is more important than any individual or this particular trade.

A trader who was fortunate enough to have purchased ‘The Stairway Trading Method’ would have had enough information to closely duplicate this trade for themselves.

Take control of your own destiny. Contact george@wdgann-lost-secrets.com for availability and price for this technique and my other courses.- George