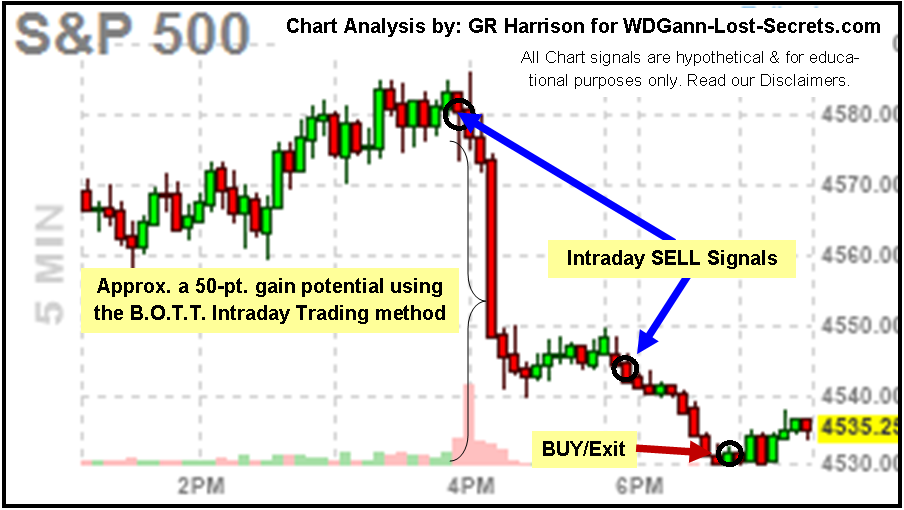

Some Beautiful Intraday Index Signals For Today [The B.O.T.T. Technique]

Today's stock indexes brought with them an excellent intraday move later in the afternoon.

In the S&P 500 (above) and the Nasdaq (below), a point of buying exhaustion took place.

Our B.O.T.T. Technique is particularly excellent in detecting these points of market weakness after peaks and gathering strength at market bottoms as well. You can see the signal points on both charts.

Both charts shown happen to have used our latest trading method release called 'B.O.T.T.'.

These are just a couple more examples of the potential profit that can be squeezed out the markets by those with a superior method of market analysis and a positive attitude.

Please note that all users of the B.O.T.T. Method will produce the same entry & exit points. These are not arbitrary or subjective points of entry & exit, however, experience has shown that not all traders will follow-through and take the signals as they're given, either hesitating or choosing to enter a little after a signal is given.

This 'Human Factor' is why track records are often misleading. People are not computers. There's an emotional component to trader's responses and the variety of those emotional responses are why every trader trades a little differently.

Keeping this in mind, the B.O.T.T. Trading Technique was designed to give the most mathematically fundamental and truthful of market analyses so that even traders who are prone to hesitate will still usually have more than ample time to enter a trade successfully.

Private Members of our Association may have access to our research discoveries & premium trading methods. Inquire by clicking the link below to drop me an email. - George

The B.O.T.T. Trading Technique is one of our Select, High Premium 'APEX' Products and the result of very extensive research and years of accumulated pieces of 'lost' knowledge which were carefully reconstructed to make one of our most powerful Techniques ever made available to our Private Members.