Stock Market Triple Top in the Making?

STOCK MARKET TRIPLE TOP COMING?

Amidst all the chaos and confusion of the markets and the latest political shenanigans, there’s been an important pattern forming in the shadows of the Stock Market.

That pattern is a Triple-Top formation and, these are important predictors of coming strength or weakness.

As you can see on the chart to the left, the last triple-top formation preceded a big break-out in prices to the upside.

As you can see on the chart to the left, the last triple-top formation preceded a big break-out in prices to the upside.

This happened in early February.

Now, the cycle has lengthened out a bit and the next top could be expected in the next week approximately.

We may have already put in a higher bottom yesterday which would be an early confirmation of the higher prices to come next week. – George

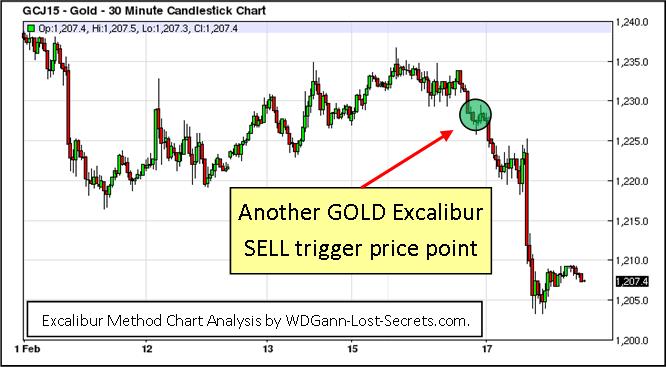

Excalibur Price Trigger for GOLD

EXCALIBUR METHOD PRICE TRIGGER POINTS TO SELL GOLD

One of the lessons we’ve drawn from our decades of research in price charts and markets is the lesson of repetitive opportunities. A good market trend presents not just one, but, many good points to join in on the trend direction.

You’ve seen many examples of it on this website as we’ve presented many examples of price trigger points during a strong market directional price move.

The Gold market has been a good example.

The Gold market has been a good example.

This trend has gone on and downwards for 3-years now.

Over and over we used a single tool to help locate optimal price points where prices were expected to break down.

The Excalibur Method detected numerous wonderful points to enter the decline in Gold and today was another example of the results of putting the Excalibur Method to work in a single market.

As shown on the chart above, a trigger price was detected last Friday.

This was the signal that Gold was expected to drop even further. Well, the Gold market decline followed through with an impressive drop of over $25 at one point today. This even with the delay of a holiday on Monday!

Yet another impressive indication that, at least one method of market analysis, actually works and does so again and again.

This will not be the last time we’ll see such impressive opportunities in this market. I’d encourage you to investigate the methodology behind these trigger points. Investigate the Excalibur Method for yourself. – George

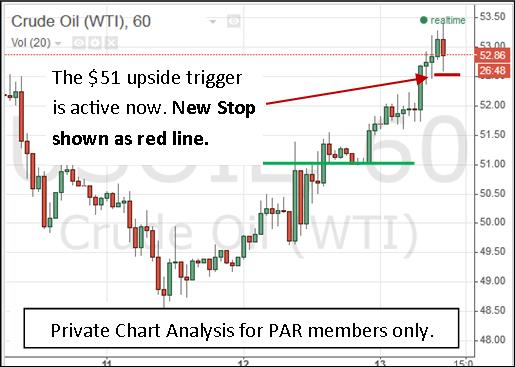

Crude Oil Reversal Profit

THE PRIVATE ANALYSIS REPORT: This is a subscription-based membership service. The content of this post is for the Private Analysis Reports (PAR) Level membership ONLY. A membership subscription may be obtained by going to this link or by clicking on the banner or the side image on this website. Be sure to read the disclaimers.

CRUDE OIL REVERSES TO THE UPSIDE

CURRENT POSITIONS:

Exited Short Bonds position using etf ‘TBT’ Mar15 42 CALL.

Long position in Crude Oil @ $51 to exit on close or at $52.50 Stop.

This Report’s Summary: CRUDE OIL broke through hourly upside trigger price @ $51.

Our Considered Response: Exit at close or on Stop @52.50.

Our CRUDE OIL Chart Follows:

Well, even though crude oil prices stayed for hours below our expected trigger price denoting lower prices, the time was not enough to overcome increased buying pressure. This, in the end was enough to take out our upside trigger of $51 today and, by at least $2 at that at one point.

I’ve switched to the hourly charts to follow this market.

I’ve switched to the hourly charts to follow this market.

The current stop on the $51 entry is at $52.50.

This is a close stop on this trade, but, this is a volatile market that can reverse it’s direction in the short-term in a heartbeat.

Exit before the weekend and take the profit on the trade or on the Stop @ 52.50.

There’s just too much that can happen over the weekend.

The Bond trade has worked well to date and the options have been up over 40% during the day.

Suggest an exit today or one may hold over the weekend.

As the options are for March the decay in value over the weekend enters into the calculations. I opt for locking in the gains at over 40% today.- George

Gold Drops as Predicted

GOLD PRICES DROPPED AS PREDICTED IN OUR EARLIER POST

Gold held out as long as it could but, in the end, the downside momentum was just too much. Prices pitched down still further as we concluded they would in our earlier posting on the Gold trigger price points.

We started our hypothetical short play at $1270 and continued to build a stronger short position at $1260.

We started our hypothetical short play at $1270 and continued to build a stronger short position at $1260.

Since then, we’ve seen where these hypothetical short prices have accumulated potential profits of $50 and $40/ounce.

This would have represented an increase of value to a futures short trader of $4,000 and $5,000.

A tidy sum indeed and all in about 10-days time. $1245 is presently our reversal trigger price.

The percentage gains from a GLD etf option would have been impressive as well coming in at around 39% increase in value within the last 10-days on a 3% move in the etf.

The present reversal price is well enough distant to be of doubtful reach with the present conditions in play. The trend is strong and downwards and, we’ll follow until clues are given to reverse. – George

Private Analysis Report – A Safer Way to Trade Forex

THE PRIVATE ANALYSIS REPORT: This is a subscription-based membership service. The content of this post is for the Private Analysis Reports (PAR) Level membership ONLY. A membership subscription may be obtained by going to this link or by clicking on the banner or the side image on this website. Be sure to read the disclaimers. The remainder of this article is blocked from public access. – George

————————————————————————

Click on the Banner above to access the latest Report

Click on the Banner above to access the latest Report

Predicted Gold Downside Price Trigger Broken

THE PREDICTED GOLD DOWNSIDE TRIGGER PRICE WAS BROKEN

The $1160 price level that we noted in a previous posting as being the trigger price indicating renewed lower GOLD prices performed as predicted today.

The $1160 price level that we noted in a previous posting as being the trigger price indicating renewed lower GOLD prices performed as predicted today.

Prices slid over $30 on a quick break below the $1160 level as shown on the chart to the side.

The attempt by Gold to break out of it’s strong downside trend finally failed after testing it’s strength with a small rally counter-trend.

Those following this steep downtrend of today should have their stops @$1246.

If prices break above this price, then they’ll be attempting to rally to the previous support (now resistance) price at $1160 again. – George

————————————————————————————————–

DISCLAIMER: All charts and commentary are presented for educational purposes only. They are not a solicitation to buy or sell any financial products. Please familiarize yourself with the other disclaimer and risk disclosure statements on this website. By accessing this post, you acknowledge reading these disclaimers and disclosures.

Euro Rally Trigger Prices

THE PRESENT EURO DAILY TRIGGER PRICES:

A funny thing happened on the way to the bottom . . .

While awaiting the decline of the EURO, it decided to avoid our downside breakthrough price of 111.00 and, instead, rallied (on a short-term basis).

As all scenarios must be entertained, it becomes most important to take note of which price point will indicate a stronger rise in price.

We’ve already flirted with one trigger price and have not exceeded it, but, the most serious one promising a strong upswing will be at the 116.00 level.

We already have the downside trigger price covered from our previous post but, a closer trigger for a downmove can be placed at 1.1225.

Prices breaking below this price will indicate a further downswing ahead. – George

DISCLAIMER

WDGann-Lost-Secrets.com would like to remind you that the data contained in this post is neither necessarily real-time nor accurate. All stock prices, Indexes, Futures, buy/sell Signals and Forex prices are indicative and not appropriate for trading purposes; furthermore they are not provided by an exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price. WDGann-Lost-Secrets.com doesn’t bear any responsibility for any trading losses you might incur as a result of using this data.

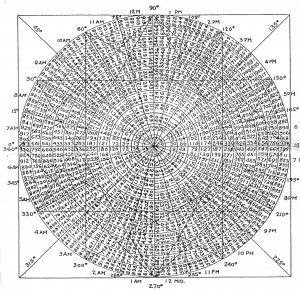

WD Gann’s Law of Vibration – Part 2

W.D. Gann’s LAW OF VIBRATION (part 2)

The mysterious Law of Vibration (as mentioned by W.D. Gann in his courses) was presented as being of fundamental importance. Unfortunately, Gann gave only a vague idea of what this law entailed and no information at all about how he used the law in his trading methods.

The mysterious Law of Vibration (as mentioned by W.D. Gann in his courses) was presented as being of fundamental importance. Unfortunately, Gann gave only a vague idea of what this law entailed and no information at all about how he used the law in his trading methods.

We can find the true source for the ‘Law of Vibrations’ in an obscure mystical text called ‘The Kybalion’ where it is called the ‘Principle of Vibration’.

The Kybalion presents the 7 Principles or laws by which the Universe works as follows:

- The Principle of Mentalism

- Principle of Correspondence

- Principle of Vibration

- Principle of Polarity

- Principle of Rhythm

- Principle of Cause and Effect

- Principle of Gender

I’ll have some more comments on these in a future article, but, for now, let’s see what was said about the ‘Principle of Vibration’.

Principle of Vibration:

“Motion is manifest in everything in the Universe, that nothing rests, and everything moves, vibrates, and circles. To change one’s mental state is to change vibration. One may do this by an effort of Will, by means of deliberately “fixing the attention” upon a more desirable state.” (bold emphasis is mine)

Mr. Gann certainly dealt with the concept of vibration through his research into what we call ‘CYCLES’ today.

And, Mr. Gann built much of his methodology for trading and timing upon the CIRCLE (which is another way to express one Vibration unit or Frequency).

And, Mr. Gann built much of his methodology for trading and timing upon the CIRCLE (which is another way to express one Vibration unit or Frequency).

He further sub-divided the circle or vibration cycles using ANGLES which are everywhere displayed on his personal price charts.

Also, it’s worth noting is that Gann also expressed the importance of keeping one’s mind focused and positive.

As Gann was a student of the esoteric and a highest-degree holding member of a Mystery School (the Masons), Gann certainly had access to this book (the Kybalion) and drew from it in his course writings and personal philosophy as well.

In fact, you’ll find every one of these 7 Principles expressed within his course within a few pages of each other. – George

Gann’s Law of Vibration: PART ONE

The Euro and Pound to Play ‘Catch-up’

EURO & BRITISH POUND WILL FOLLOW THE REST DOWNWARDS

I’ve watched with amusement starting last Monday as the prices for the Euro as well as the British Pound acted like all was well and the backdrop of news on Greece was of no importance whatsoever.

Where prices were expected to at least reflect some of the negativity that is the EU today on Monday, prices instead climbed.

However, these actions are only the window dressing for a scene resembling the time when George Soros forced the British Pound to devalue. Hundreds of millions were spent then, and, I’m convinced are being spent now, to give the public the illusion that ‘all is well’ with the currency.

Here’s what’s shown on the chart for the Euro and British Pound presently:

The Euro has been the most stubborn to accept the fact that it’s going down even more and has managed to have 3 higher closes over the past 5 days of trading. This is pushing the probability limit for a market in a strong declining trend and lower prices should be expected to follow.

The British Pound shown below also had a run of 3 higher closes in the last 5 days but, the last 2 days have been lower close days and the steam has run out of this forced upswing it appears.

These aren’t the only currencies in the World however and, further clues as to the future direction of currencies may be gleaned from two other important currencies; the Australian Dollar and the Canadian Dollar.

These aren’t the only currencies in the World however and, further clues as to the future direction of currencies may be gleaned from two other important currencies; the Australian Dollar and the Canadian Dollar.

First, the Australian Dollar:

The Australian Dollar has shed the illusion of a false upswing and already continued it’s honest journey South in price.

The Australian Dollar has shed the illusion of a false upswing and already continued it’s honest journey South in price.

The Canadian Dollar has been even more honest having put in only a single higher daily close in the last 5 days time.

A serious continuation downwards has begun again for the Canadian Dollar, but, this currency won’t be alone.

In summary, we’ve been presented with a ‘show’, an illusion relative to the Euro and the British Pound over the last several days. This has been for Public Relations only and a smokescreen as the charts reveal.

Previously propped up by their sister currencies (like the Australian & Canadian Dollars), one-by-one those other currencies are leaving the Euro and British Pound behind by continuing on the only path they can take at the moment – DOWNWARDS.

When the Euro & GBP finally let go, they will have to play ‘catch-up’ with a highly probable fast move down. Watch for it. – George

Eur/Usd Trigger Price Points

THIS POST IS RESERVED FOR MEMBERS ONLY.

To view the details and chart of the following post, please join the WD Gann Trader’s Group. This is a free level of Membership which allows early notification of posts and access to special market reports detailing market ‘break’ points, major trends and trend shifts.

——————————————————————-

HERE ARE THE TRIGGER PRICE POINTS FOR THE EUR/USD

The severe weakening of the EUR/USD continues with prices poised on the ledge of a support price of 1.1160. Should prices break down through this support price, then the next potential support area won’t be encountered until prices hit 1.0850.

As you’ll see, these important price points are shown on the chart following. . .

All charts are shown for educational purposes only and are not a solicitation to buy or sell financial products.

It’s most important to state here that the Eur/Usd has broken an important price point on the longer-term basis and has a very high probability of reaching 1.0525 on the downside; a goodly drop from present price levels.

Because of this longer-term high probability, it’s most likely that we’ll penetrate the shorter-term support levels of 1.1160 and 1.0850.

Prices breaking below either of these supports will likely be followed by swift declines to the next support price areas. This is a volatile market as are these times for the EU. – George

——————————————————————————————————————–

DISCLAIMER: All charts and commentary are presented for educational purposes only. They are not a solicitation to buy or sell any financial products. Please familiarize yourself with the other disclaimer and risk disclosure statements on this website. By accessing this post, you acknowledge reading these disclaimers and disclosures.

Aus/Usd Indicates That It’s Tripping . . .

THE AUS/USD IS TRIPPING LOWER

This is a quick post alerting readers to the immanent weakness of the AUS/USD.

The above chart shows where the trigger price points for the AUS/USD are at present. Prices closing below these points indicate strong weakness immediately ahead. – George

——————————————————————————————————————–

DISCLAIMER: All charts and commentary are presented for educational purposes only. They are not a solicitation to buy or sell any financial products. Please familiarize yourself with the other disclaimer and risk disclosure statements on this website. By accessing this post, you acknowledge reading these disclaimers and disclosures.

Gold Uptrend in Motion

THE LATEST GOLD UPTREND STOP & SUPPORT AREA

NOTE: What Follows is TIME SENSITIVE INFORMATION. For the next few days, this article will be viewable by Members Only.

JOIN TO VIEW.

Our previous GOLD article on Jan. 7th targeted the $1260 price as the confirmation point for a new uptrend in the Gold market.

That price was met and exceeded and the price of Gold has risen by as much as $43 above that targeted breakthrough point. This represents a value increase of as much as $4300 per futures contract on this rapid swing over the last few day’s time.

The chart above shows that the present support level for this upswing rests at the $1250 price level.

The chart above shows that the present support level for this upswing rests at the $1250 price level.

This is a Stop level based on the Daily price chart only. Should this upswing extend itself further, we can expect to rapidly advance this Stop support level. – George

——————————————————————————————————————–

DISCLAIMER: All charts and commentary are presented for educational purposes only. They are not a solicitation to buy or sell any financial products. Please familiarize yourself with the other disclaimer and risk disclosure statements on this website. By accessing this post, you acknowledge reading these disclaimers and disclosures.

A Refined Analysis of Crude Oil

WD GANN: SOME REFINED ANALYSIS ON THE CRUDE OIL MARKET

The mysteries of the recent massive decline in Crude Oil are many, but, two questions of import rise to the top of the list . . .

- Why such a massive decline?

- And, how can we tell when the decline is either over or going to continue?

THE FIRST QUESTION: Well, the first question is simply that Time ran out for CRUDE OIL at high prices.

The approximately 30-year Commodity Cycle which last strutted it’s stuff in 1980 was due and came at last to the crude oil market as it did to the grains, copper and gold markets.

THE SECOND QUESTION: As for the second question of where we are within the Crude Oil downtrend, we’ll further refine our answers in the next two charts which follow and which may provide some valuable guidelines to temper our emotions when watching the daily price action.

Many expect a rebound in price. Perhaps even a reversal in the trend. But, how will you determine ‘the real deal’ from the ‘hopeful’ emotional response?

WD Gann, THE market master from the last Century found several ways to answer these questions.

Indeed, these rediscovered techniques of his have proven, at least to me, that Gann was a true Renaissance Man.

As a market analyst genius, he is, even today, largely unappreciated and undiscovered by the vast majority of investors and traders who think his claim to fame are a few stories, some strange angles, mysterious circles and enigmatic squares which he left behind in some notes, charts and courses.

One of the marks of true genius is, however, when the techniques discovered still work over a Century later!

Yes, Time is the great tester of Truth.

So, let’s take a look at Crude Oil, like we did previously for the Stock Market and Gold through WD Gann’s eyes, so to speak and applied to today’s price charts.

The chart below shows where the present invisible Resistance price level is for Crude Oil.

A counter-trend will have to be able to break through the $55.00 price area to confirm enough buying pressure is available to absorb the selling pressures presently in the market.

This answers the question as to if we’re in an uptrend or not: Until prices rise above 55.00 and hold; we’re still in a downtrending market.

At present, we’re experiencing a pause in the downtrend. The next question becomes then; how will we know if the downtrend is going to resume? That answer is also supplied from the lost Gann secrets and is illustrated on the chart below for your examination . . .

The chart below shows where the present invisible Support price level is for Crude Oil.

This chart answers the question as to if the downtrend will be continuing or not: Until prices fall below 41.00 and hold below that price; we’re still in a sideways trending or holding market for Crude Oil.

These are the price limits for support and resistance on a daily basis for Crude Oil as of this date. – George