What’s Gold Up To? Going Beyond the News

GOLD’S IN THE NEWS AGAIN. WHAT’S IT MEAN?

Word is out that Gold’s on the rise again and that the Bear market in Gold has ended.

Who says so? Why the media experts and, of course, the gold dealers who are perennially long the metal.

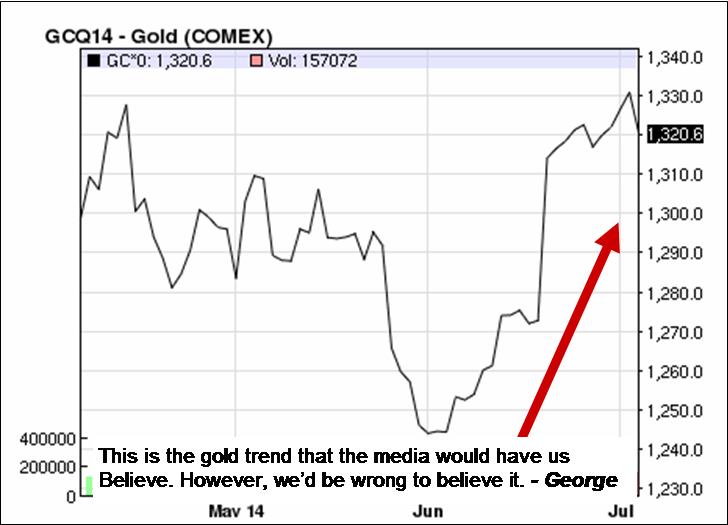

If you look at the short-term clipped charts offered to back this in the news, they look like this:

As mentioned in the previous post, the media’s job is to mislead so as to benefit the big players in the markets.

If we fall for this small selected piece of gold price history we’d be falling into a trap and we could be seriously mislead as to the future of this precious metal.

The chart to the left is unbalanced in it’s presentation to traders and investors and, is yet another example of an attempt to place investors on the wrong side of a major market move. In this case, GOLD.

Yes, some profits have been possible short-term on the long side but, is this a market that promises a great deal more upside?

Let’s take a look at a longer time period for prices in this market and discover what so many don’t want you to discover.

And, what is that? Simply this, the Gold market is STILL IN A SERIOUS DOWNTREND on a long-term basis and IN A SIDEWAYS MARKET on the medium-term.

Take a look at the next chart for proof:

This chart clearly shows that we’ve been locked into a sideways market for almost 2-years now.

Prices are only at the middle of their range at present, so, they can still go higher while not indicating a new Bull Market at all!

In order to work this sideways range you’ll need a tool that can protect you from too many whipsaw plays

(like that used on this site).

This website’s intention has always been educational and the design of the methods used to analyze the markets has always protective of the trader and investor. To do that I’ve had to discover and re-discover (in Mr. Gann’s case) the fundamental laws of the markets and their structure. By doing so and analyzing markets with these tools, a more stable and reliable result can be found. One that inspires growing confidence with use.

The results speak for themselves as the archives will show and my mission has been to teach the principles and methods that will allow you to do the same for your own interests and investments.

If you want to know more, take the time to click the banner below and send me an e-mail requesting price and regional availability. Thanks. – George