Crude Oil Timing

IF YOU WERE A MEMBER . . .

. . . YOU’D BE SEEING OUR LATEST CHARTS REPORTS RIGHT NOW!

FOR MEMBER-EXCLUSIVE ACCESS & MORE DETAILED VIEWING:

CLICK HERE

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Crude Oil: Timing the Shift in Trend

NEW UPDATE: 8/29/15

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

[private_GANN TRADING GROUP]

OUR ONGOING CRUDE OIL SHORT TRADE SELECTION HAS FINALLY ENDED & REVERSED TO LONG

Today’s post is an update on our previous short trade in Crude Oil since June.

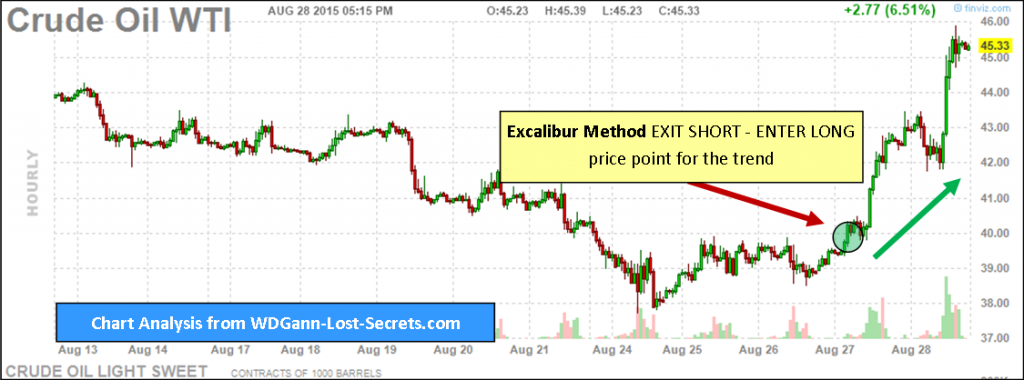

Using the Excalibur Method (and confirmed by other Master Course techniques) we detected a shift in the price momentum in WTI CRUDE OIL on August 27th.

This price point of focus was $39.50, with prices above this triggering an exit from our theoretical Short and reversing to a Long outlook; but, only on a very limited short time frame.

This price point of focus was $39.50, with prices above this triggering an exit from our theoretical Short and reversing to a Long outlook; but, only on a very limited short time frame.

Here’s the reason: The angle of ascent for price now is too steep from the August 27th breakout to Friday; far too steep to maintain. However, this won’t prevent us taking the opportunity to take our theoretical grab at a bit of this upside action and get into position for the next down leg when this upsurge breaks (as it must).

We’ll have to follow the upside movement at a shorter time frame rather than the daily chart level shown above.

What to watch for: If new highs are not made and If we get an hourly bar that closes below $44.60 with most of it’s bar range below that price; then, we may assume that the short-term upsurge is over, and, a continuation of the previous downtrend will continue. – George [/private_GANN TRADING GROUP]

Crude Oil: The Patient Road To Profitability

IF YOU WERE A MEMBER . . .

. . . YOU’D BE SEEING OUR LATEST CHARTS REPORTS RIGHT NOW!

FOR EXCLUSIVE VIEWING:

CLICK HERE

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Crude Oil: The Patient Road To Profitability

NEW UPDATE: 8/15/15

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

[private_GANN TRADING GROUP]

Crude Oil: The Patient Road to Profitability

I’ve written in times past about the valuable ability to stay with a trading position. It’s really the only way to take advantage of the big annual commodity price moves.

Indeed, when it came to the Art of Patience, the great stock trader Jesse Livermore stated that:

“After spending many years in Wall Street and after making and losing millions of dollars, I want to tell you this: it never was my thinking that made the big money for me. It always was my sitting”.

It just takes time to acquire and accumulate the profits that the truly significant trends bring with them.

Perhaps another quote from Mr. Livermore will help to confirm this principle:

“Patience is the Key to Success, not speed. Time is a cunning speculator’s best friend if he uses it right.”

Jesse Livermore had learned the Patience Lesson after much pain and loss.

W.D. Gann also had this Patience factor as one of his crucial Rules for Trading stating: “When you make a trade, you must have the patience to wait for opportunities to get out right, or to make the profit.”

Patience in holding a ‘winning hand’.

Such has been the case with our selected Crude Oil trade where the Excalibur Method of Market Analysis gave a sound signal back on on July 1st to SELL Crude Oil at $56.94.

As you can easily see on the chart, the downtrend for Crude Oil has remained in force and, remains so right up to Friday’s close shown above.

As you can easily see on the chart, the downtrend for Crude Oil has remained in force and, remains so right up to Friday’s close shown above.

The uptrend took took several months to form and peak. Now, that we’re in a downtrend for Crude Oil, it will likely last several months as well before ending. What we’ll look for first, is a decline in the price momentum; a slowing down of the speed of the market decline.

You can detect this slowing down of price momentum with properly structured geometric angles applied to one’s price charts.

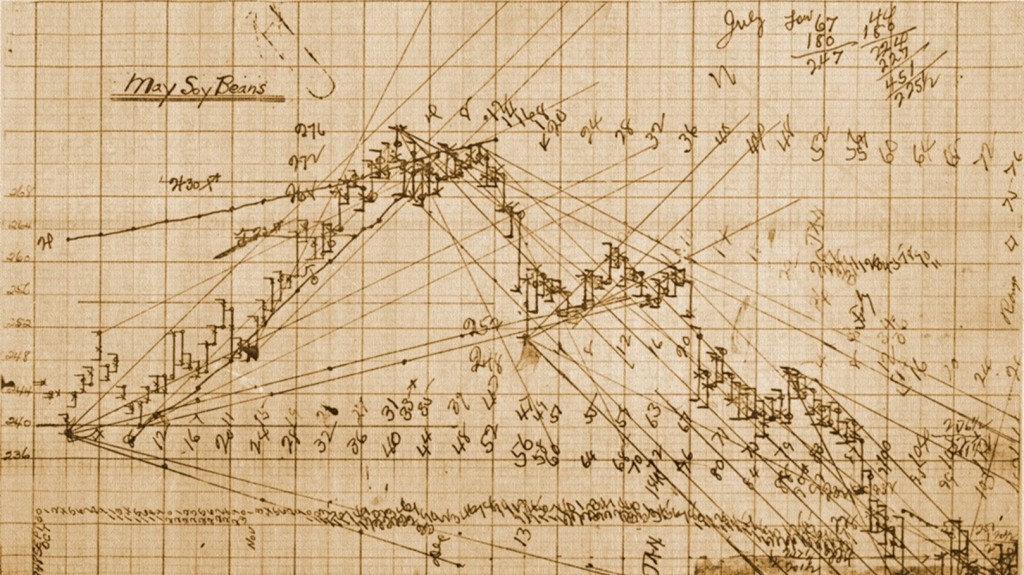

W.D. Gann used angles extensively on his charts as you can see on his Soybean chart below.

The several purposes of the angles and their proper placement and interpretation was an ‘inner’ (and secret) level to Gann’s work.

The several purposes of the angles and their proper placement and interpretation was an ‘inner’ (and secret) level to Gann’s work.

This level of Knowledge will certainly help in bringing one’s attention to a slowing of a market’s current trend. Without this understanding though, the chart above looks confused and confusing.

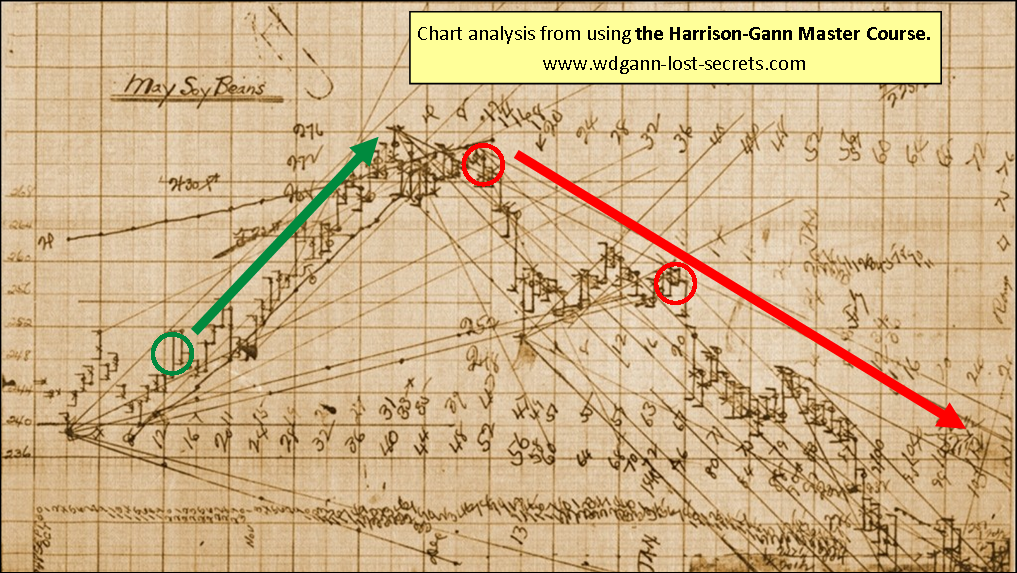

Here’s what can be discovered from a deeper understanding of the angles and their uses:

The green circle would be an early indicator to BUY Soybeans and the green upward sloping line confirms what happened afterwards.

The green circle would be an early indicator to BUY Soybeans and the green upward sloping line confirms what happened afterwards.

After the top was put in, the top red circle shows just where one could detect EARLY that the Soybean uptrend had changed direction and was going to go lower in price. This was the first SELL signal in this market.

The second red circle shows another entry SELL point indicating still lower prices ahead.

There are, of course, other hidden secrets at work on this and Gann’s other price charts that help to refine both price objectives and timing of market turns. It would be my pleasure to convey those secrets to those who wish to raise their market understanding to a much higher level.

If you’re serious about improving your understanding and market skills, then, please contact me by e-mail about price & availability for either the Excalibur Method or the Harrison-Gann Master Course. – George [/private_GANN TRADING GROUP]

Short the China Stock Market . . . BEFORE the Crash!

FOR EXCLUSIVE VIEWING:

CLICK HERE

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SHORT THE CHINESE STOCK MARKET … BEFORE THE CRASH!

NEW UPDATE: 8/9/15

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

[private_GANN TRADING GROUP]

NEW UPDATE: 8/9/15

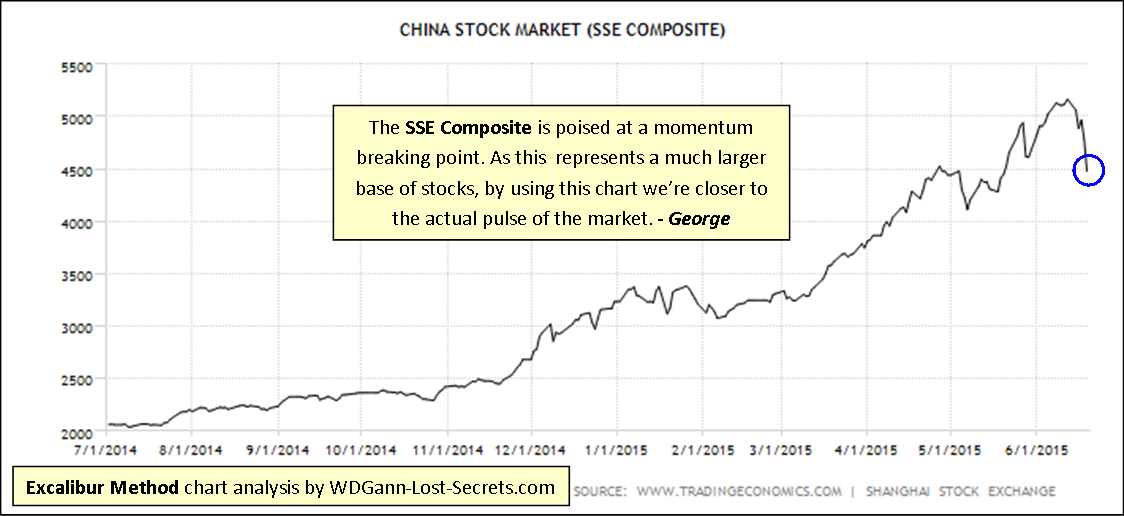

Back on June 22nd, we warned that the Bubble in the China 25 Stock Index was popping and, this, well BEFORE THE CRASH.

Note when the Chinese stock market was first noted to be weakening internally as shown by the blue circle on the chart below which was first published on June 22nd of this year:

This was a very early warning, (as is our custom) that gave ample opportunity to get in position with Puts in the FXI and wait for the next move to happen.

This was a very early warning, (as is our custom) that gave ample opportunity to get in position with Puts in the FXI and wait for the next move to happen.

Well, it did in a big way with the incredible crash of Chinese stocks across the board on both the Mainland and Hong Kong markets.

It only takes a few good calls like these to make a very comfortable living and we do this routinely as the market conditions allow.

Yet, recently, the news has shown that one major fund manager lost $500-million in the commodity markets for his clients.

Meanwhile, our Crude Oil super-profit opportunity trade (and many others) have been posted and updated on record on this website. We clearly saw (and see) what that, (and most other) fund managers could and will not; the Big Market Picture. The True Market Picture.

Another example in the last few weeks revealed that the Swiss National Bank bought over 500,000 shares of Apple computer stock at the top of the market just before the severe 10% drop. Clearly, even the largest of traders and banks need a better way of analyzing markets; because what they’re doing isn’t working!

How are we able to do what so many, even super-large traders, are not?

The short answer is that we’ve spent over 45-years developing unique indicators to identify market turning points, natural stop prices and targeted price objectives.

This is founded on decades of experience, research, original market discoveries and unique applications in analyzing just what markets are up to at any particular time.

More important is How These Skills Can Serve Your Financial Goals & Needs.

Investing is all bottom-line, when everything is said and done. When you use our services or educational products, you’ll be locating the most profitable market opportunities and early, when there’s still plenty of profit to be made in them and before the crowds even become aware of them.

So, how did the above warning about the Chinese Stock Market Bubble popping turn out? Let’s view the chart . . .

Early purchases of Puts of FXI would have positioned one comfortably for the collapse of prices to come.

Early purchases of Puts of FXI would have positioned one comfortably for the collapse of prices to come.

In less than one-month’s time, a huge, leveraged profit would have been presented.

All this while the rest of the World was wringing it’s hands in despair wondering what to do.

It was too late at that point.

But, if you had been an owner of the Excalibur Trading Method and used that special approach to looking at this market, yours would have been a story much different from the millions without this special insight.

The Testimonials for Excalibur are all unsolicited and from excited and very satisfied students and clients from around the World.

There are even greater depths of understanding the Markets which lead to even better results. For example, in reference to the China 25 Index shown here, an even earlier SELL notice could have been discovered by those who had learned the techniques contained within the Harrison-Gann Trading Secrets Master Course.

SUPERIOR RESULTS MEAN LIMITED ACCESS

The Excalibur Trading Method is priced appropriate to it’s great value and, will not be for everyone.

If you’re not willing to let others control your financial destiny any longer . . .

. . . then, The EXCALIBUR TRADING METHOD, is clearly meant for you.

If this best describes your intentions, then, you’re most welcome to learn some of these amazing techniques for yourself.

I’ll be delighted to hear from you. You can drop me an e-mail for pricing and availability by clicking HERE. – George R. Harrison [/private_GANN TRADING GROUP]

Following Crude Oil’s Downtrend

FOR EXCLUSIVE VIEWING:

CLICK HERE

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

FOLLOWING CRUDE OIL’S DOWNTREND

UPDATE: 8/7/15

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

[private_GANN TRADING GROUP]

UPDATE: 8/7/15

With this update on our Crude Oil predicted SELL we’re able to tack on several more points of profit potential to our earlier call on July 1st to SELL Crude Oil at $56.94

Price for WTI Crude Oil dropped further today down to $43.75 by NY Close.

This brings the dollar profit potential for this predicted downtrend to over $13,000 per single contract or $65,000+ per 5-lot and $130,000 on a 10-lot trade. All this since July 1st when our INITIAL post went online.

This is just another example of the advantage that accrues to those who are able to interpret important shifts in the market.This kind of asset building information doesn’t come from ordinary market tools or software. Those tools are only dealing with effects and not monitoring the CAUSES of market events!

This highest-level of market knowledge is still available to those who make the effort to acquire, learn and apply it.

Inquire HERE to request price and availability of our special trading course materials. – George

[/private_GANN TRADING GROUP]

Oil Prediction Spot On

[private_GANN TRADING GROUP]

OUR JULY FIRST CRUDE OIL ALERT PAID OFF . . . HANDSOMELY!

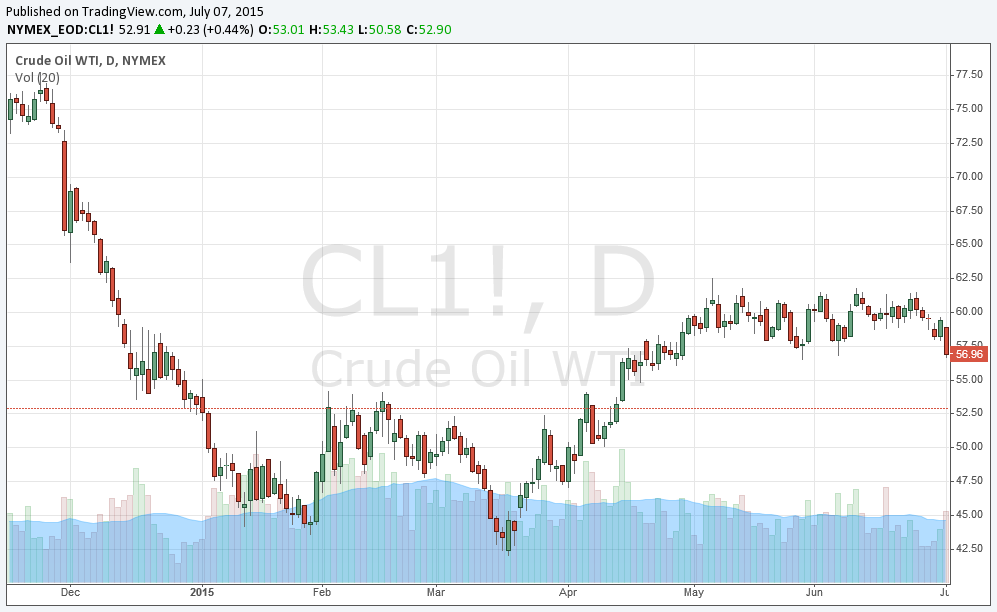

The First of July I issued an ALERT to our group warning that Crude Oil had crossed an invisible price pivot point. The price at that time was at 56.94 (see the chart above).

The First of July I issued an ALERT to our group warning that Crude Oil had crossed an invisible price pivot point. The price at that time was at 56.94 (see the chart above).

The price has dropped down, to the 50.60 area as shown on the current chart shown below. This represents a drop of over $6 or a potential profit of $6,000 per full contract or $30,000 on a 5-lot trade. – George

[/private_GANN TRADING GROUP]

Stock Market Countdown

[private_GANN TRADING GROUP]The S&P 500 stock index has also not yet recovered from it’s initial fall this week.

There’s one more day for it to do so in order to rebuild it’s upside strength again.

Today’s gain sets the stage for a possible weekend surprise that could lead to a gap in prices to the downside Monday.

We’ll need to monitor tomorrow’s price movements to better assess that potential. – George

[/private_GANN TRADING GROUP]CRUDE OIL Alert

[private_GANN TRADING GROUP]MEMBER REPORT FOLLOWS:

Crude Oil prices have now triggered a SELL Alert.

This low is not the same as the previous ones at this price level.

53.00 is a realistic price objective to the downside and, possibly lower.

This market has lost it’s support momentum and, is poised for a steep decline again. – George

[/private_GANN TRADING GROUP]DOW Update

[private_GANN TRADING GROUP]This is a DOW update to yesterday’s post.

Price action over the next few days will become very important in determining the condition of the American Stock Market over the following weeks and months. What do I mean by this? . . .

The price weakness detected in the Dow Jones Industrial Average (DJIA) and shown on our previous post will hold only if prices over the next two days stay below 17,920.

The price weakness detected in the Dow Jones Industrial Average (DJIA) and shown on our previous post will hold only if prices over the next two days stay below 17,920.

Should prices surge upwards above this price resistance point either tomorrow or Friday, then, momentum will have been regained at a critical point and a resumption of the previous long-term uptrend will be likely to continue.

This will require some strong buying to accomplish, but, is still possible. – George

[/private_GANN TRADING GROUP]DOW Shifts Downwards

[private_GANN TRADING GROUP]

The DOW Stock Index Has Shifted Downwards in Trend

Today’s price action has shifted the momentum for the DOW to a downward trend for, at least, the short-term.

Should prices continue their present weakness, there’s a good deal of buffer for price movement with the DOW support favoring 17,125 initially should prices weaken further.

Should prices drop further, we can expect that 16,550-16,600 will contain the long-term trend momentum upwards which we’ve enjoyed for years now. If prices break below these numbers however, a much greater shift downwards in prices will be indicated. – George

[/private_GANN TRADING GROUP]EURO Prepped

[private_GANN TRADING GROUP]

How You Could Have Prepped For The EURO Drop A Week Ago . . .

The big price drop on Sunday for the EURO should not have caught one by surprise.

Indeed, those using the Excalibur Method for their chart analysis could have detected the critical turn to the downside for the EURO at the point indicated by the blue rectangle.

This price trigger point to SELL would have been produced over 5 days ago, leaving one short on Friday and well-positioned for the huge gap down on Sunday’s open.

Positioning for Downside Potential Using the Excalibur Method Click Chart to Enlarge.

Proper analysis and positioning based on it, even a few days in advance, can make all the difference.

Please take the time to read more about the process, and then, if you then wish to obtain it for yourself, e-mail me here for price and availability. Thanks. – George

[/private_GANN TRADING GROUP]Chinese Stock Bubble Deflating

THE CHINESE STOCK MARKET BUBBLE IS DEFLATING

Beyond the emotion and removed from the hype, let’s determine the real state of the Chinese Stock Market.

Here we’ll use the US etf (exchange traded fund) with the symbol FXI to examine the state of the China 25 Index.

Here’s the stock index chart as analyzed by the Excalibur Method.

Excalibur is excellent at determining shifts in market momentum, and, in the case of this market, has found a breakdown in continued upward price momentum (see the chart).

The China 25 Stock Index is an important index, but, is it reflective of other areas of the Chinese financial markets?

For that insight, let’s take a look at another larger China-based index chart, the SSE Composite.

The SSE Composite (Shanghai Stock Exchange Composite Index) chart shows a market poised at a weak pivot point.

The slightest shove downwards at this point and this market will very likely go into a significant price slide downwards.

This will be a monthly trend shift only however at this time.

The quarterly trend continues to remain strongly in place for now unless the FXI were to drop below 40. – George

Doing the Right Thing

Our approach to finding significant moves and breaking points in the markets paid off again this week with the EUR/USD trade today as described in the previous article.

The kind of skill required to make accurate predictions of this kind is the result of decades of research and experience on my part.

This single play in the EUR/USD was potentially worth almost $2,000 per full-contract for the EUR/USD.

WISDOM IS THE GOAL AND WISDOM TAKES WORK!

“King Solomon was greater in riches and wisdom than all the other kings of the earth. The whole earth sought audience with Solomon to hear the wisdom that God had put in his heart.” 1 Kings 10:23-24

“WISDOM IS THE PRINCIPAL THING: THEREFORE, GET WISDOM AND WITH ALL THY GETTING, GET UNDERSTANDING.” – King Solomon; Proverbs 4-7

I’m happy to have shared yet another example of these skills in reading the markets with you this week. These are skills, you should note, that are available to all who want them and are willing to put a little effort into learning.

Nature herself requires that there are costs in Life that have to be paid to progress to a higher level.

Your cost for the valuable information on the EURO, however was: ZERO.

But, there’s a point to such free predictions (from yours truly), and that is this:

If you leveraged your gains from such ‘gifts’ by purchasing one of the trading courses offered on this site, in my opinion, you could elevate your own skills in the game of trading immensely. You’d gain personal Courage, Independence and Empowerment from such knowledge and, the World is in short supply of such powerful individuals today.

In fact, the World today desperately needs you to become that Courageous, self-actuated individual. From such people are true Leaders drawn.

HERE’S WHAT I OFFER YOU FROM THIS WEBSITE:

My intent is to help any trader or investor to better become independent and self-actualized.

But, HELP IS A TWO-WAY STREET.

I’m willing to work with anyone with true desire to learn the secrets of WD Gann or the Markets.

Budget is not a limitation for those who truly desire and are willing to put in the work required to master the techniques I teach here. I want to pass on these market discoveries and techniques to a new generation of open minds and hearts.

However, HELP does not mean free and, it doesn’t mean that it will come to you without cost or action. That just isn’t Nature’s way.

You have to make the effort to, at least, e-mail me with your inquiries, requests and to possibly tell your personal trading story. This small effort could be a big boost to get you started and on your way towards a higher level of understanding the markets.

I look forward to hearing from you soon. Sow the seed to reap the Harvest. Make the effort. It takes energy to set things in motion in Life. – George

Predicted Euro Trigger Worked

The predicted Eur/Usd trigger of 1.10 given in the May 29th post worked like a charm today.

Today’s price action moved past our trigger entry area and rocketed higher for one of the truly great trading days to be long the Euro. – George