You Must Change Your Perspective!

The View of the Crowd is just that . . . 'their' view.

That common viewpoint forms up the so-called 'consensus' view of what 'reality' is for a market at any particular point in time. Essentially, the majority of market participants (and, a large group of manipulators) get to vote on what's happening and what's 'real' in any particular market. But, . . .

What's Really Happening Out There?

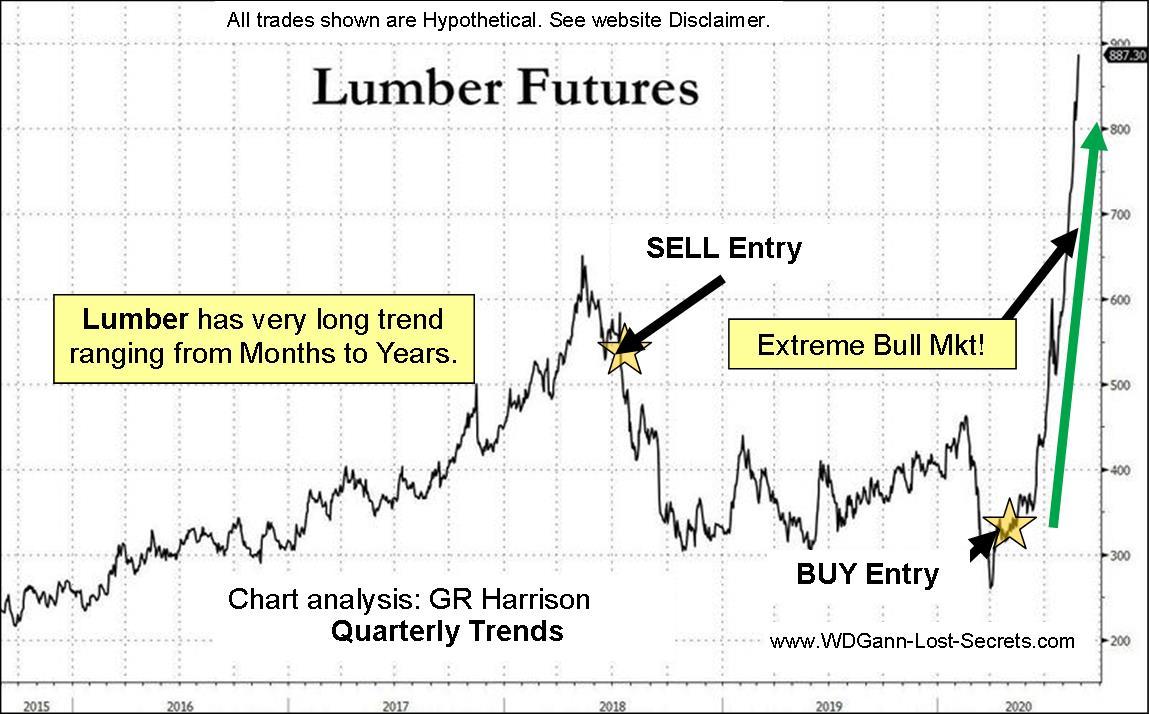

To be able to discern what the masses cannot, we have to remove ourselves from the charts, time-frames and techniques of the everyday investors. Otherwise, how can we come to an objective conclusion unless we 'change our perspective' and take in the longer-view to form our conclusions?

This is equivalent to looking far down the railroad tracks to see if a train is coming or not! We can do the same with charts.

The First Step: Get A Longer Time Perspective.

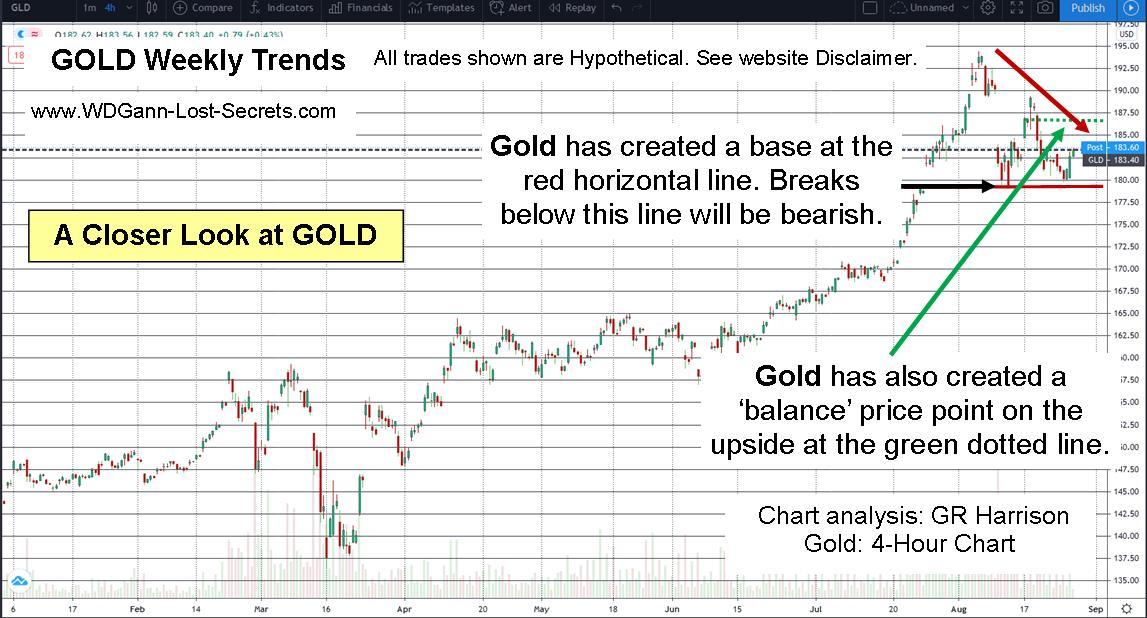

The first way we can accomplish this is to change the time frame for the price charts we're looking at. If you're an intra-day trader working the 5-minute bars, you have far too much company doing exactly the same thing. You should, instead, consider pulling outwards in Time to, at least, the Hourly level bar or candlestick charts. 3-Hours would be even better.

Plot the charts at these new and longer-time frames and step back to observe what can be seen.

As you can see with the above 5-minute vs. the 3-hour charts, the 3-hour chart gives one important information that is just not obtainable from the 5-minute perspective of the market.

This new time perspective will place you in a different place of judgment from the place that your trading competitors are making their decisions from. This is the first step in your process of discovery.

The Second Step: Use Unique Trading Techniques.

Your Next Step is to use non-conventional and unique chart analysis techniques (like those exclusive trading methods provided to our Clients).

Just as one should look at different charts than most traders do, one should analyze these charts using tools that the masses will never have access to. Successful techniques that are unknown except to a very specific and exclusive Group; a Group who have put in the effort in Time & Money to become successful at levels above and beyond those of other average traders.

The Final Step: Use Risk-Management Techniques.

Apply Risk Management to each trade one decides on and you'll have the 3-Critical Keys to finding profitable markets and exceptional trading opportunities.

I've written extensively on this topic over the years on this site and others. This is the critical common element to ALL trading successes. Do Not Let Losses Run. Take your losses earlier, not later. They never grow smaller if you need them to! You Must Manage Risk for every trade.

Individual Courses Will Soon Become Unavailable

In order to provide a more complete trading method selection experience, I'll be consolidating most of the individual Courses over the coming weeks into Specific Application Collections (for example: A 'Simple System Secrets Collection', 'Intra-day Trader's Collection', 'Inner Secrets Collection' (Master Course), 'Complete Writings Collection', etc..).

Once this is finalized, no further individual Courses will be sold; they'll only be sold as part of an appropriate Collection or Set. This means that prices will rise considerably, thereby limiting access to these methods even more in the months or years ahead. However, as these Courses are targeted towards Professional Traders and Qualified Investors, then, this should not prove a difficulty for these groups.

Please don't e-mail me for details on the Collections as they're not finalized as yet. I'll post to this website when more details are available.

These will be the final days to purchase the separate trading Courses as, once the Collections are set up, all individual courses sales will cease. - George