AN ELECTION-YEAR RALLY IS THE 'RULE', NOT THE EXCEPTION

. . . THAT'S WHAT WHAT THIS CYCLE DOES HISTORICALLY!

Building upon our previous post, we find further evidence that shifts probabilities for a strong Stock Market Rally in our favor with the examination of a historical cycle for the stock market during Election Years like this one.

The Election Year chart at the top of this article is founded on 116-Years of data!

This shouldn't be treated lightly, but, always remember that all cycles break at some point in time and, that's why we use more than once corroborating historical base and method to confirm and follow these trends.

Be More Informed and Less Fearful of the Future

Knowing the Historical Cycles and repetitive themes of the markets can have a calming effect overall when one is contemplating the markets.

This will put you in a truly small group of those investors who can calmly assess and react to the market while ignoring the panic headlines and crowd mentality.

Most will indeed be 'surprised' by a strong Market going towards the elections.

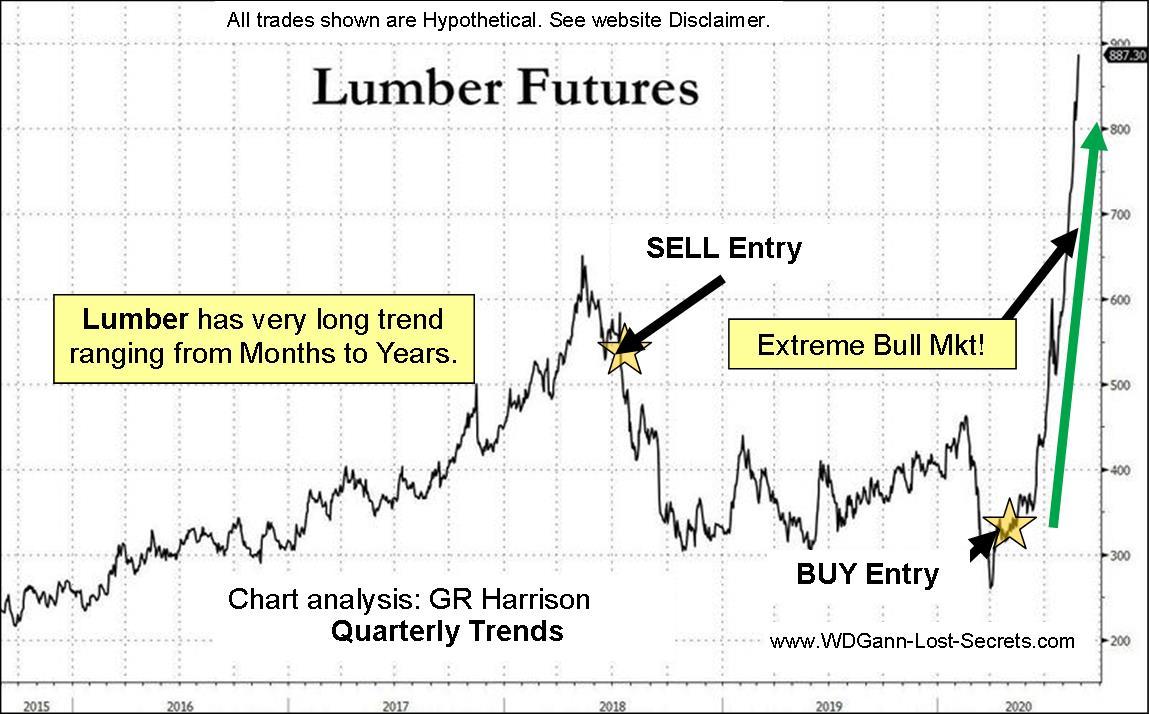

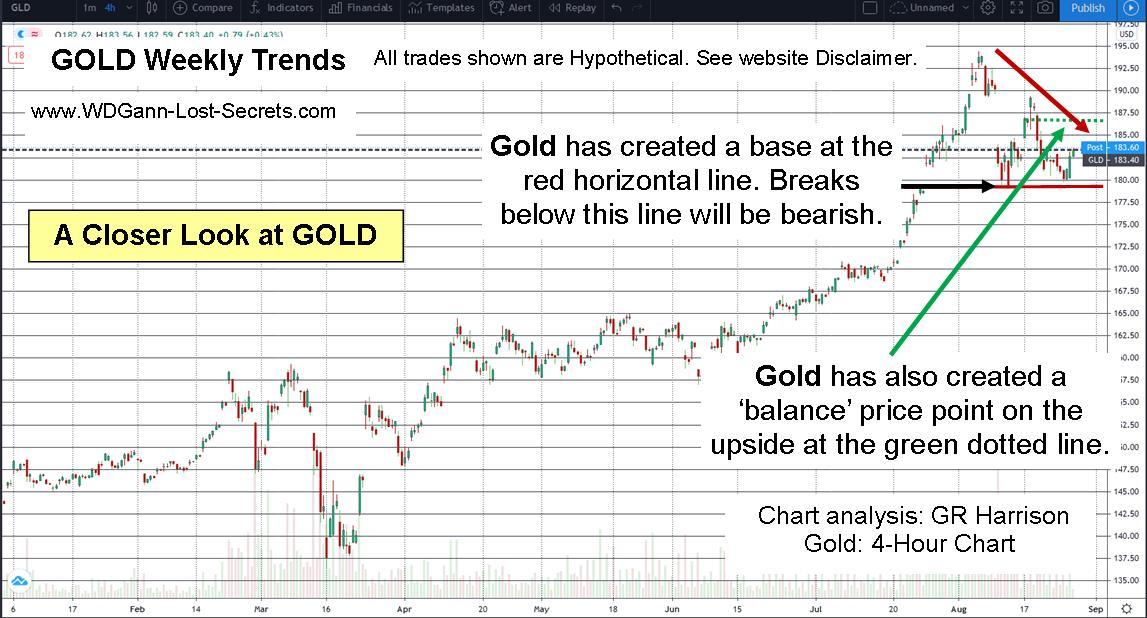

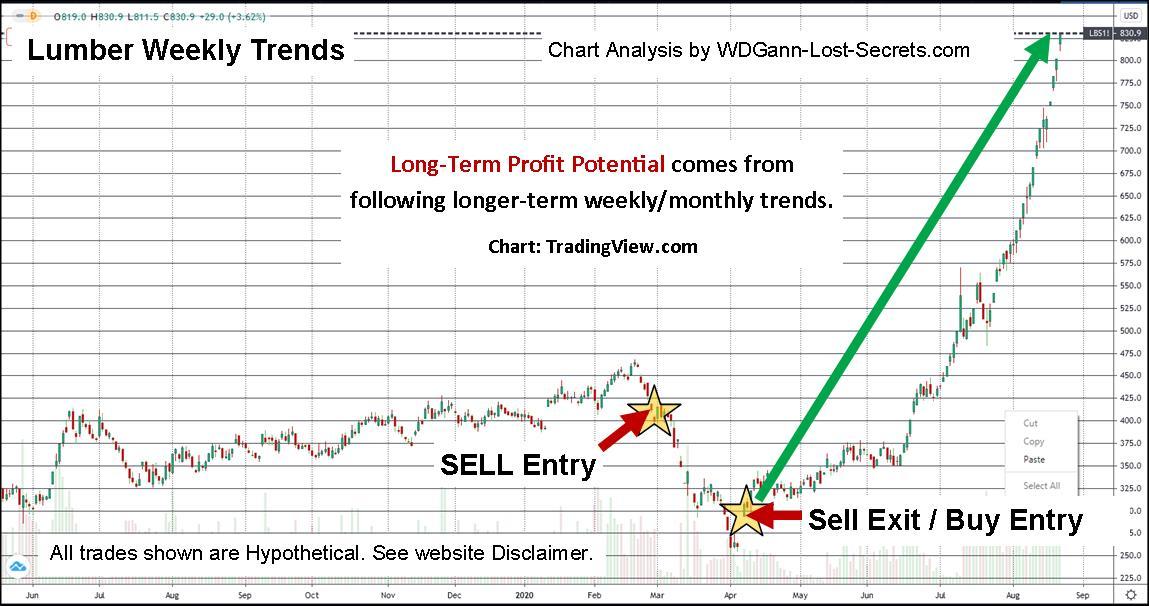

Trends are powerful things and, the ability to get on board a rising or falling trend is where the big returns are historically. We have the tools and educational materials that will instruct you on how to detect these potentially profitable points in time early.

Our Proprietary half-century of research is now available to a few private clients.

You can gain access to our Excellent Trading Courses or our Master Course Collection today.

We're allowing Limited Access to these private discoveries through our Special Gift Program.

The 'Master Course' Special Gift Installment Program

As stated on our HOME PAGE, we've now cleared access for up to two new client/students each month for our Master Course Collection at a very special gift request level.

Here's What You'll Receive With Our Special Gift Program

This Special Gift Program will allow you to receive the courses either all-at-once or on an installment gift basis (if you wish to assimilate the information over a longer period of time).

Enter your text here...

Contact me at the e-mail address below and get started today. - George

Enter your text here...