HOW INVESTORS COULD HAVE AVOIDED THE SWISS FRANC SHOCK

With the latest shock to some currencies from the Swiss National Bank dropping the peg to the Euro, it shows how some currencies seem to have been converted into deflating-value commodities.

And, (as the recent dramatic pullback on Thursday showed), it would be safer to consider some of these currencies as commodities and pull back on the leverage applied to one’s forex trades and to bring margin levels down to levels common with futures contracts (this being preferable to risking devastation to one’s positions caused by unexpected central bank actions magnified by 500:1 or higher levering.

Here’s the Deflationary environment we find ourselves currently in (shown with the charts below). Note, all these markets are presently in Downtrends with their values declining monthly, weekly and, in some cases, almost daily.

Are these down trending commodities really that different from . . .

All of the above markets have this in common . . . THEIR VALUES ARE DECREASING. DEFLATIONARY PRESSURES ARE IN PLAY.

Below are some major currencies that have the same alarming problem . . . THEIR VALUES ARE DECREASING. The same assumption can then be made as with the commodities above; Deflationary Pressures are in Play.

. . . these down trending Currencies?

When separate things have the same fundamental processes in progress, they, become largely, one-and-the-same for all intents and purposes during that time period. So, currencies that act like commodities ARE commodities during such periods. Only the names distinguish them apart at present as larger economic forces are leading all of them down the same road in the same direction.

The real question to ask now, in retrospect, is whether traders and investors could have aligned themselves to protect themselves from the volatility of a day like yesterday BEFORE IT HAPPENED or not.

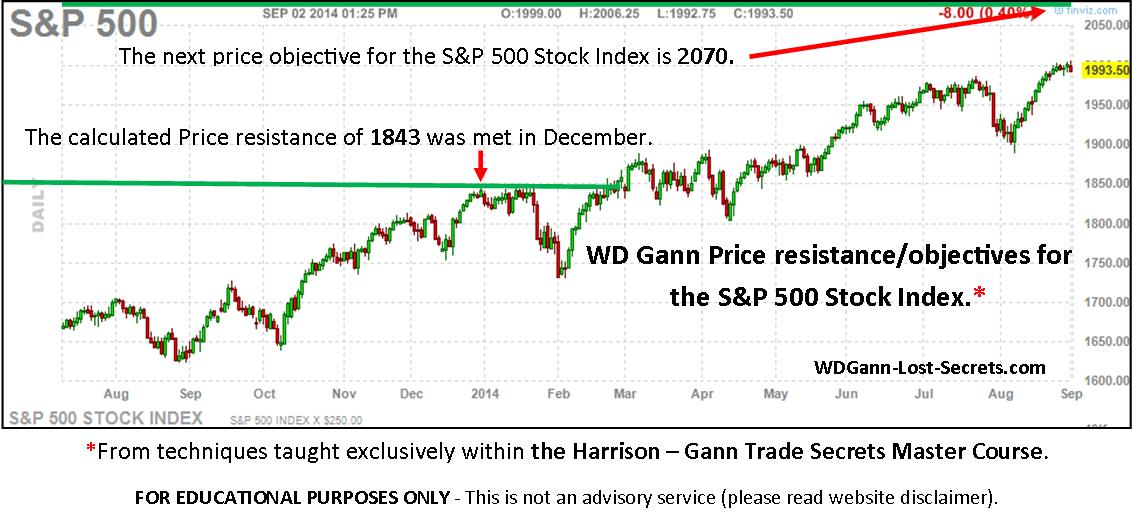

The answer appears to be yes and the means of doing so were those advocated in the past by WD GANN himself.

Primarily, he wrote that one should always be aware of the monthly and weekly trend for a market and follow, not fight it.

Let’s briefly see how this would have played out according to this approach.

- First, it’s clear that commodity prices are still in decline from their 2011 peak of the cycle (the weak Currencies should now be considered as part of this Commodity Trend). Therefore, one should NOT be taking Long positions in a declining weekly or monthly market. The Swiss Franc situation was unique in that it was a strong currency that was pegged to another weakening currency (the Euro). When released, it compensated for lost time and value by springing upwards by over 20% at one point.

Most who were hurt from the Swiss Franc were depending on it for stability. However, once it became pegged to another currency, the SF became dependent on non-Swiss economic policies and decisions. In short, conditions for their own currency were subject to forces outside of Switzerland. This altered the former stability of the Swiss Franc to something fated to fail in the long-run.

- A quick look at a price chart for the weekly & monthly price levels of the Euro reveals the real trend showing why action had to be taken by the Swiss while there was still time.

To their credit, the Swiss took action to protect themselves, but, the shock of their self-preserving actions are still reverberating through the markets.

What needs pointing out here is that the basics remain:

- A strong US Dollar continues to strengthen.

- A weakening Euro continues to weaken taking those associated currencies along for the slide (C. Dollar, Australian Dollar, British Pound).

Had low-leveraged short-positions been taken in the major weakening currencies listed above (instead of a currency pegged to still another currency – a (second-tier investment and higher risk investment), or, in the ever-strengthening US Dollar, then, investors would have not only weathered the storm of yesterday’s news, but, also would have found themselves in a more profitable position today (being on the right side of their chosen currency’s major trend). – George