The Stock Market: Shifting Momentum

THE STOCK MARKET’S SHIFTING MOMENTUM

What we’ve been witnessing with the Stock Market these last months (beneath the hype and headlines) is the shifting of price momentum. I’ve outlined this process with the red arrows on the chart following . . .

This has slowed this previously hyper-trending market’s advance to a non-trending, sideways entity.

Essentially, the market has become (depending on one’s perspective) either ‘boring’ or ‘precariously balanced on a cliff’. Perspective, however, is very point-of-view slanted and, is therefore, non-objective.

Perspective is emotion-laden (because of it’s point-of-view nature) and not to be trusted in the investment or speculative arena. It’s important to rely on objective means of evaluation and to use those tools consistently.

While the popular ‘points-of-view’ about this market are displayed everywhere on the net it seems, almost no one discusses the upside potential to this strong market.

Here’s how things look to the upside from this perspective (using opinion-independent tools) . . .

The usual trap before breakouts to higher levels consists in taking out the previous highs (implying an immediate higher price breakout). However, this event alone will not be enough to indicate the renewal of the strong trend upwards.

Instead, don’t expect the trend to be seriously established until price goes through 18,300 on the DJIA on the upside.

This price area will keep one out of the price-choppy action which comes with sideways moves.

As for the downside break (which far too many are expecting – not a good sign), the same trick will likely be attempted in reverse. Lower lows taking out the previous lows implying (the ‘Trick’ again) that prices are going to break down seriously and immediately. They won’t, however, on this basis alone.

It will take even lower prices to lock that into place. Let’s take a look at the downside support . . .

Keep in mind the slowing momentum of the Stock Market, which should still be viewed as only a pause in the trend until proven otherwise by prices penetrating the support area presented above.

Keep in mind the slowing momentum of the Stock Market, which should still be viewed as only a pause in the trend until proven otherwise by prices penetrating the support area presented above.

Don’t be taken in by any quick price moves at either extremes (of high or low) and, instead, allow a little price ‘buffer’ space both above and below our present sideways price range. – George

Forex Shocks: How Investors Can Avoid Them

HOW INVESTORS COULD HAVE AVOIDED THE SWISS FRANC SHOCK

With the latest shock to some currencies from the Swiss National Bank dropping the peg to the Euro, it shows how some currencies seem to have been converted into deflating-value commodities.

And, (as the recent dramatic pullback on Thursday showed), it would be safer to consider some of these currencies as commodities and pull back on the leverage applied to one’s forex trades and to bring margin levels down to levels common with futures contracts (this being preferable to risking devastation to one’s positions caused by unexpected central bank actions magnified by 500:1 or higher levering.

Here’s the Deflationary environment we find ourselves currently in (shown with the charts below). Note, all these markets are presently in Downtrends with their values declining monthly, weekly and, in some cases, almost daily.

All of the above markets have this in common . . . THEIR VALUES ARE DECREASING. DEFLATIONARY PRESSURES ARE IN PLAY.

Below are some major currencies that have the same alarming problem . . . THEIR VALUES ARE DECREASING. The same assumption can then be made as with the commodities above; Deflationary Pressures are in Play.

When separate things have the same fundamental processes in progress, they, become largely, one-and-the-same for all intents and purposes during that time period. So, currencies that act like commodities ARE commodities during such periods. Only the names distinguish them apart at present as larger economic forces are leading all of them down the same road in the same direction.

The real question to ask now, in retrospect, is whether traders and investors could have aligned themselves to protect themselves from the volatility of a day like yesterday BEFORE IT HAPPENED or not.

The answer appears to be yes and the means of doing so were those advocated in the past by WD GANN himself.

Primarily, he wrote that one should always be aware of the monthly and weekly trend for a market and follow, not fight it.

Let’s briefly see how this would have played out according to this approach.

- First, it’s clear that commodity prices are still in decline from their 2011 peak of the cycle (the weak Currencies should now be considered as part of this Commodity Trend). Therefore, one should NOT be taking Long positions in a declining weekly or monthly market. The Swiss Franc situation was unique in that it was a strong currency that was pegged to another weakening currency (the Euro). When released, it compensated for lost time and value by springing upwards by over 20% at one point.

Most who were hurt from the Swiss Franc were depending on it for stability. However, once it became pegged to another currency, the SF became dependent on non-Swiss economic policies and decisions. In short, conditions for their own currency were subject to forces outside of Switzerland. This altered the former stability of the Swiss Franc to something fated to fail in the long-run. - A quick look at a price chart for the weekly & monthly price levels of the Euro reveals the real trend showing why action had to be taken by the Swiss while there was still time.

To their credit, the Swiss took action to protect themselves, but, the shock of their self-preserving actions are still reverberating through the markets.

What needs pointing out here is that the basics remain:

- A strong US Dollar continues to strengthen.

- A weakening Euro continues to weaken taking those associated currencies along for the slide (C. Dollar, Australian Dollar, British Pound).

Had low-leveraged short-positions been taken in the major weakening currencies listed above (instead of a currency pegged to still another currency – a (second-tier investment and higher risk investment), or, in the ever-strengthening US Dollar, then, investors would have not only weathered the storm of yesterday’s news, but, also would have found themselves in a more profitable position today (being on the right side of their chosen currency’s major trend). – George

Gold Update

The last GOLD post was our preliminary look at Gold at the beginning of 2015. We started at the intraday level, examining the current state of balance at that level. What we found was that the intra-day, short-term outlook was weak and, two short Excalibur Method trigger signals were generated.

The last was issued as a SELL point when posted and, indeed prices dropped rapidly after posting by another $15/oz. or $1500/contract within 2-hours time! Prices rapidly bounced back upwards again (as shown on the chart) taking out the hypothetical hourly Excalibur short position and was a good place to reverse to an hourly Long position. which has continued to hold up to the time of this post write-up. This upwards bias for price movement can be viewed on the chart following which shows bands representing selling pressure (the lower band) and buying pressure (the upper band).

. It must be kept in mind at all times that even this little upswing needs to be placed in proper perspective. This price movement is nowhere near enough to counter the downtrend in Gold going back to 2011.

. It must be kept in mind at all times that even this little upswing needs to be placed in proper perspective. This price movement is nowhere near enough to counter the downtrend in Gold going back to 2011.

That trend is strong and has enormous momentum still. However, major trends always begin as minor trends first, so, we’ll keep an eye on the market while noting the ‘bigger picture’ trend. The chart below is a closer time perspective going back a year.

That trend is strong and has enormous momentum still. However, major trends always begin as minor trends first, so, we’ll keep an eye on the market while noting the ‘bigger picture’ trend. The chart below is a closer time perspective going back a year.

We continue to find a strong downtrend in progress and one that hasn’t been interrupted to this point. A price move above (and, staying above) $1260 is needed to overcome the downside selling pressure in this market. – George

We continue to find a strong downtrend in progress and one that hasn’t been interrupted to this point. A price move above (and, staying above) $1260 is needed to overcome the downside selling pressure in this market. – George

GOLD: Intraday Chart

We’re starting the New Year out looking at the intraday GOLD market to assess how it stands.

First observations are that we’re in a weak position on the hourly and even on the daily with (Excalibur Method) SELL triggers already given twice.

Check out the chart . . .

The red ovals show the first points of trend change. Keep in mind we’re looking at half-hour bars here, so, this trend is short for the short-term within the larger trend. Expect a drop from here especially if we complete a half-hour bar whose range is largely lower than the oval indicated price area of $1154.

An uptrend will require that we take out the $1192 price level with bars and their ranges above this price. Again, this would be an extremely short-term trend.

This is just a preliminary look at GOLD, we look deeper in the coming days ahead. – George

A Great Investment Year Ahead!

In these closing days of 2014, I’d like to thank you all, (Clients, Students and readers alike), for an exciting year of discovery, teaching and market predictions.

The Holidays are a useful time to reassess the year past and place emphasis on the positive events and how they have brought us to today. The Year 2014 offered lots of positive market surprises. Positive, that is, for those who saw them coming and made plans to accommodate the change.

We can look forward to even greater potential for change going forward into 2015.

There are some really strong trends that are approaching or are reversing this coming year. Change is afoot and change is where the greatest opportunities for rapid appreciation of profit occurs.

The title of this article: ‘A GREAT YEAR AHEAD!’ needs a little explanation, lest it be misunderstood. Let’s define a ‘Good’ Year as one that an investor can survive and prosper through.

A ‘Great’ Year then, we’ll define is one in which we not only survive and prosper, but one in which we profit so greatly as to offset YEARS even DECADES of previous results. That would truly be a Great investing Year would it not?!

We’ll only be able to do this by following the tide of History and the Markets.

Anticipation of upcoming great events based on sound mathematical rules, places one at the ready for those events and in the best position to profit from them. These are the tried and true rules of good business.

Cycles of War Create Cycles of Prosperity

Among the fortunate discoveries uncovered during our continued WD Gann, independent research work and, associated with the Law of Vibration has been finding uncanny years and decades of repeating events that lie far beyond the markets alone.

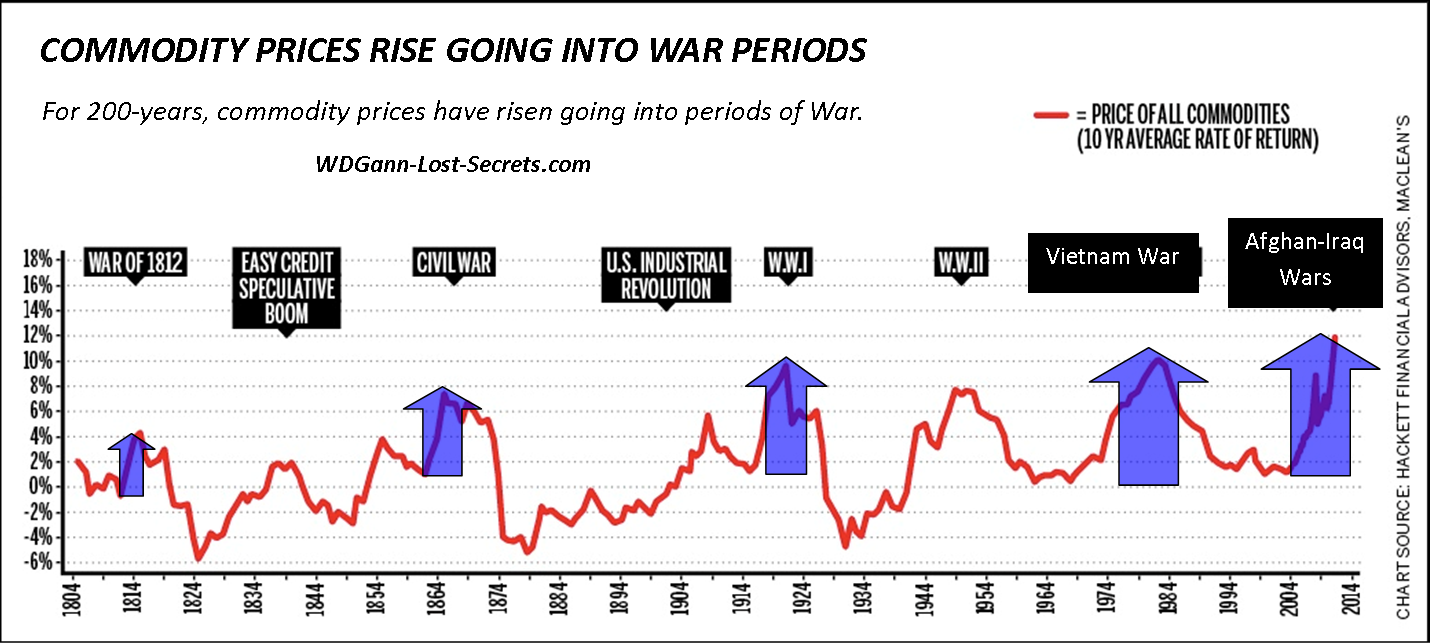

The Cycles of War and Prosperity are just two of these arenas. Though talk of war is unseemly at this time of the year, even Mr. Gann called attention to the fact that these very war periods brought about rising commodity prices and were strong drivers of markets.

Indications are that we’re in the early lead-up years to such a time again and moving towards that period (in 2019-2020) that will be very vulnerable to pressures for a new war period.

As can be seen on the 200-year commodity chart above, this cycle is almost constant in it’s application.

In short, it’s a ‘Rule’ you can largely depend on and a confirmation tool for the times we’re in. Although the chart above doesn’t cover our 2014 period, we’ve continued the price trend downwards from their peak in 2011. Therefore, despite the headlines, downtrending commodity prices indicate that there’s low risk of a major war at this time.

When prices start flirting with breaking out of this downtrend or prices begin a new rising trend, that would be an important sign that the rumblings of war are starting to reach a significant worldwide level.These ‘rumblings’ are too low to be heard by the common man but not too low to affect prices which reflect the change in demand by the parties planning wars. This is a bit early (about 4-years early by my count), but, something we should stay on the lookout for during this next year.

Once we’re aware of the ‘Times’ we’re in, and, we finally come to accept that Mankind hasn’t changed it’s behaviors or responses in the last several hundred (or thousands of ) years, then, we can prepare for the inevitable and home in on the details using simple historical checklists to confirm the trends under way.

Ultimately, We All Want Security

As businessmen and women, we can’t afford to get caught up in the emotions of events. We must deal with the reality of events.

That being the case, we seek out our security by finding the profit within the reality of events or markets.

Whether a market is going up or down, we, as investors, are in the unique position of being able to profit from both up and down price movement events! However, to fully take advantage of this opportunity, we can’t afford to assign an ethical or emotional context to what is clearly a historical (and mathematical) event. In other words, ‘what’ the market is which we’re trading (or the news or unpopularity behind it) should not be our main concern. Rather, ‘how’ a market is behaving within the boundaries of it’s unique structure and cycles should be our focus.

Let History Be Our Guide

Analysis is required to give us the context of a market’s actions and History can also guide us in the broad sense.

If, for example, our premise and analysis indicates that a major world war period is coming, then, we should also look at the surrounding economic and political environment for supporting signs that would accompany such an event as we move towards it in Time.

What should we look for as confirming signs?

Commodities should start working their prices upwards from strong declines going towards and during war years.Watch for this.

Politics: History shows that Worldwide political chaos comes on stage with new shifts in power bases dominating the pre-war scene. Reading the headlines today will certainly confirm that this is present today: CHECK.

The Economy: International economies tend to be in flux with money seeking safety in the world reserve currency of the time: CHECK.

The PEOPLE: During these periods the masses get restless and lawless. War is a great distraction to quiet threats to the political ‘status quo’. Political parties act only to save themselves and not the people whom they claim to represent. CHECK.

Well, you get the drift here. There are already a few confirming elements (3 out of 4 in the above list) to our future war premise and, those confirmations which revolve around the markets (changing of long-term trends) offer special profit opportunities especially during these very times when others will be confused, distracted or frozen in fear.

Remember, we don’t have to ‘like’ the events that are coming, but, they’re coming anyways.

We just have to be able to take advantage of the reality that this is how it is. There are mathematical cyclical and karmic reasons for repeating these tedious periods so, we can’t stop the karmic judgments of entire nations single-handedly nor should we attempt to for our own good.Rather, we need to become aware of the flow of events and where they’re headed. Then, place ourselves in the appropriate and best rewarding position as events unfold as they inevitably must.

Success in the markets lies in the Knowledge of Times & Trends as well as knowing the ‘signs of the times’ that we’re in. Count on the fact that knowledge drives out fear. Without fear to restrain & confuse us, there are no limits to opportunities to take advantage of except those limits we set for ourselves.

Get ready for a truly Great Investment Year! – George.

Crude Oil Price Objectives

Where is Crude Oil Heading?

Clearly, the lion’s share of the profit from this down move has been given out already. While prices have been dropping over $10/barrel each month.

Now that we’re down into the $55 dollar range, this rate of decrease can only have less than 4-months remaining before we reached the extreme lows of $10/ barrel reached at the lows of the last crude oil cycle.

And, furthermore, if we project outwards just one more month of $10 declines we’d reach the price of zero; free oil. An event that can be written off as impossible with high reliability.

What does this tell us then?

Well, markets at their extremes seldom move linearly so, the the 4-month timeline is unlikely, but, interestingly, that time period would take us past the high demand Winter Season and into Spring with lower-demands nearer their expected time for low prices.

The recent rapid rate of decline is likely to slow within this $50 region and, even rebound some from these lows to gather strength for the next down leg. This will extend out the 4-month rate of decline scenario and allow for a more gradual decline taking more time to reach ultimate lows. – George

The Excalibur Method of Market Analysis is offered ONLY from this webpage source.

Please contact George HERE for price and availability.

As noted in the previous post, there will be a price increase for all courses (including the Excalibur Method) on January 1st.

Show Me the Money-(flow)!

SHOW ME THE MONEY (Flow)!

By George R. Harrison

TRACKING MONEY-FLOW THROUGH VALUE SHIFTS IN MARKETS

We’ve all heard of the old magicians trick of distracting with one hand while the other is where the real set-up is taking place.

It seems we’re up against the same process at work in the markets we’re experiencing today.

There’s a fundamental and major shift taking place. Everyone feels the ‘vibe’ of it, but, where’s the proof (instead of the speculation) to bear out the truth of it?

It’s not to be found from conventional sources, that much is clear.

Like trying to detect the secrets of the magician, we need to focus on what the ‘other hand’ is up to.

When it comes to markets, a one-dimensional approach isn’t enough to reveal the whole multidimensional story.

Charts for stocks or commodities tend to be one-dimensional in that they’re generally denominated in that market’s national currency and this very fact can disguise the effects of that market relative to the international flow of money.

In other words, the question that needs answering is: ‘Is the international, ‘smart’ money flowing towards the market in question or away from it back into the world reserve currency (the US DOLLAR)?‘

Take the Bombay Stock Exchange index (BSE) for example in the chart below . . .

A quick one-dimensional look shows a strong bull market rise with, what looks like a normal downside reaction taking place within the trend.

However, to gauge a foreign market’s international VALUE, it needs to be compared with the world reserve currency, which, at this time, is the US DOLLAR.

A shift in a market’s value relative to the US Dollar, will reveal where the international flow of money from that market is headed. This will, in turn, reveal underlying strengths or weaknesses that may not be immediately obvious in the local currency denominated chart for that market.

When we compare the BSE to the US Dollar and chart that, we see something more revealing:

What shows as ‘weakness’ on this chart (the recent pull-back in prices) is now revealed to be something more serious as the money flow is shifting towards the US Dollar internationally and away from the BSE.

This is a powerful perspective shift that can alert traders and investors to fundamental shifts in markets which can only be seen relative to the reserve currency of the US Dollar.

By the way, this shift towards the US Dollar during the recent economic jitters is understandable and, it does affect the markets.

The US Dollar has soared in value to an exponential rate that will be unsustainable by it’s very nature.

This flow of purchasing dollars is being driven by worldwide factors that have created instability or at least the perception of instability.

The smart money moves, and is moving, to the most secure or perceived secure locations.

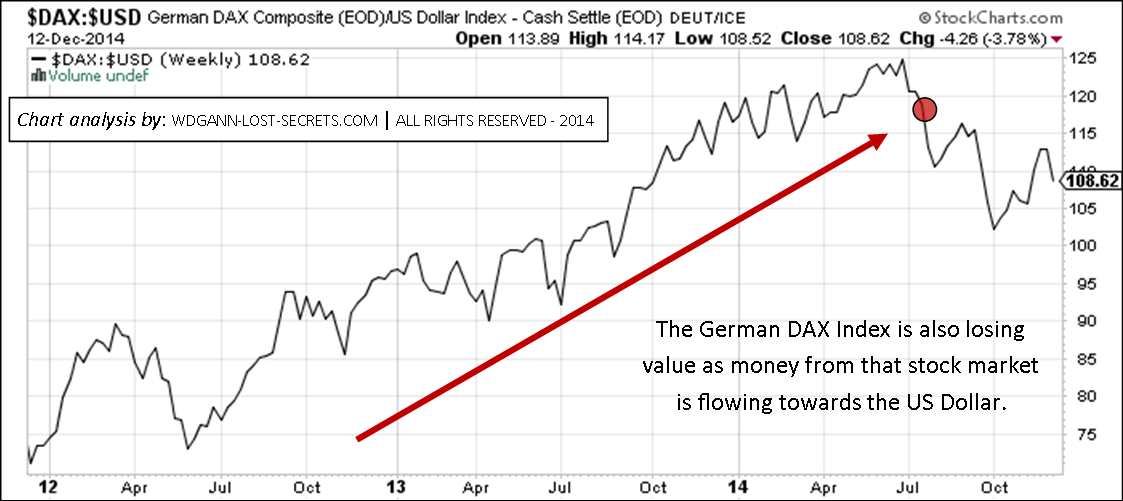

By way of example, note how the German Stock Market (DAX) is reflecting the same world-wide trend:

The shift for this market started back in July and never looked back.

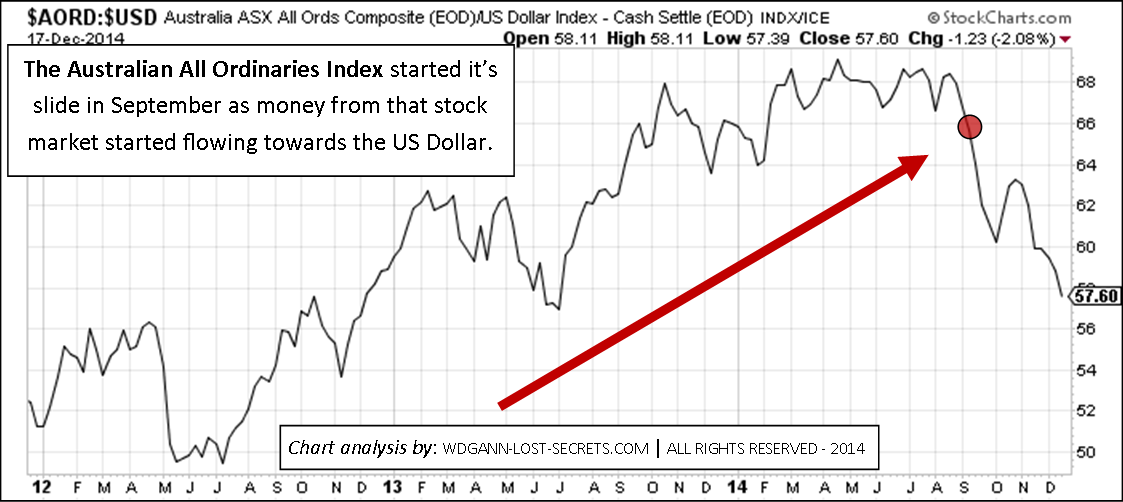

On the other side of the World, as represented by Australia, we see the same loss of value and shift towards the US Dollar from the All Ordinaries Index:

Clearly, significant sums are migrating from different nation’s stock markets and buying US Dollars for investment in dollar-denominated products.

This significant trend will have a monetary-system wide effect that will be hard to explain using the usual one-dimensional chart analysis.

The US DOLLAR is a powerful factor at work behind the scenes and one which we’ll examine further in the days ahead. – George

© 2014 Copyright George R Harrison – All Rights Reserved

george@money-tigers.com

Disclaimer: All articles and posts are a matter of opinion (drawn from over 44-years of market research & experience) and are provided for general information purposes only and are not intended as investment advice. Information and analysis above are derived from sources and utilize privately discovered methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisers.

From the website: http://www.WDGann-Lost-Secrets.com

—————————————————————————————-

Bio: George R. Harrison’s background includes time as a Hedge Fund assistant manager; an intensely focused 44-year long period as a researcher of the Markets, a Master Market Analyst & Chartist; recognized by Gann-trained clients from around the world as a uniquely qualified, modern-day WD Gann expert, (having rediscovered and restored-to-print many ‘lost’ Gann techniques through his decades of research work) and creator of several revolutionary market analytical techniques and tools.

Mr. Harrison continues his market research & private client consultation and instructional work while living on the island of St. Croix in the US Virgin Islands.

SPECIAL: Mr. Harrison now offers limited, private one-on-one advanced instruction in a resort setting on St. Croix in the Virgin Islands.

George may be contacted by e-mail at: george@money-tigers.com

Asia: Sand in the Gears of the Bull Market

Asian Markets:

Sand in the Gears of the Bull Market

By: George R. Harrison

The Asian Stock Market scene has been dynamic and strong. At least until some sand got into the gear works a few months back and started to grind the bull markets to a halt.

The ‘canary in the coal mine’ was first spotted in the Malaysian Stock Index.

Malaysia’s stock market has been the weakest of the 4 we’re looking at here and, as the chart shows, has fallen around 7% in the last 3-month’s time.

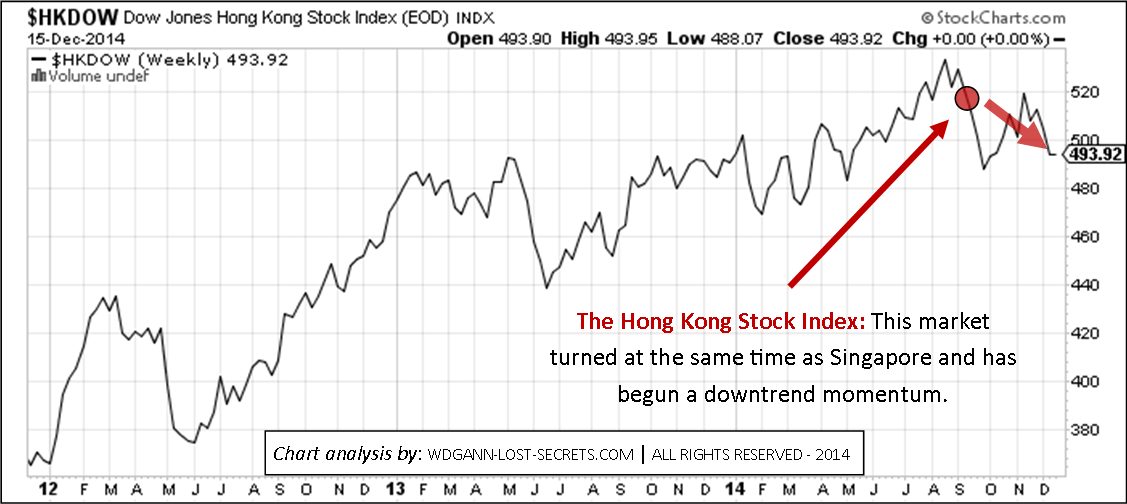

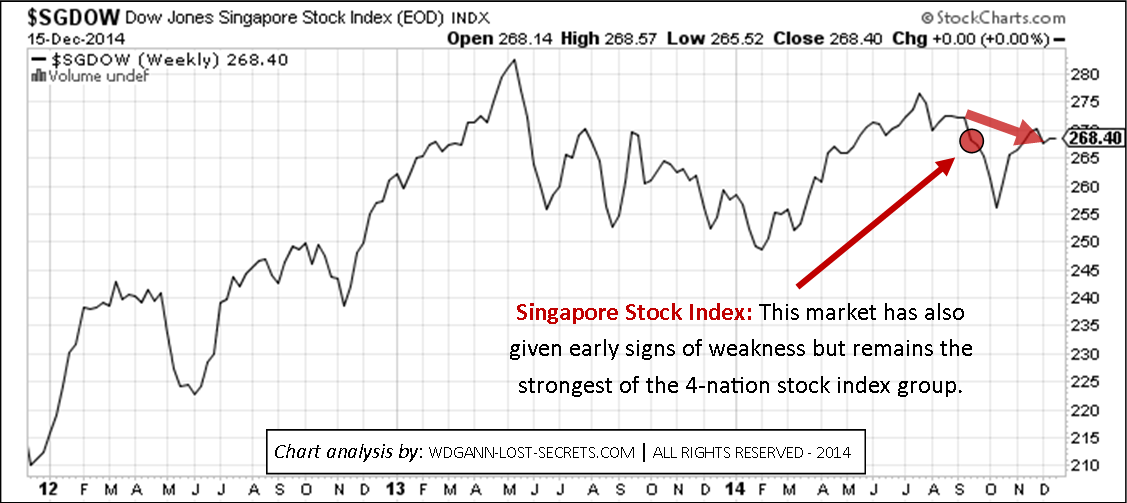

The Malaysian Stock Index decline also made it’s appearance known in both the Hong Kong and the Singapore Stock Indexes . . .

Near mid-September, the train ride upwards became derailed, hesitating and then started working it’s way further on the downtrending slope.

Singapore, the financial capital of the region, reacted and mirrored the shift at the very same time.

The main difference between Hong Kong and Singapore Stock Indices is that Singapore has weathered the shift much better, showing itself to be the stronger market of the two during this time period.

Of course both of these markets are huge compared to Malaysia.

No doubt that the continuing massive movement of funds to Singapore (leaving nations perceived as less safe and secure) has gone a long way towards keeping the index stronger, even after it’s initial falter.

However, all is not well in the region and there are plenty of ‘signs’ that indicate that a slowdown and trend change are in progress.

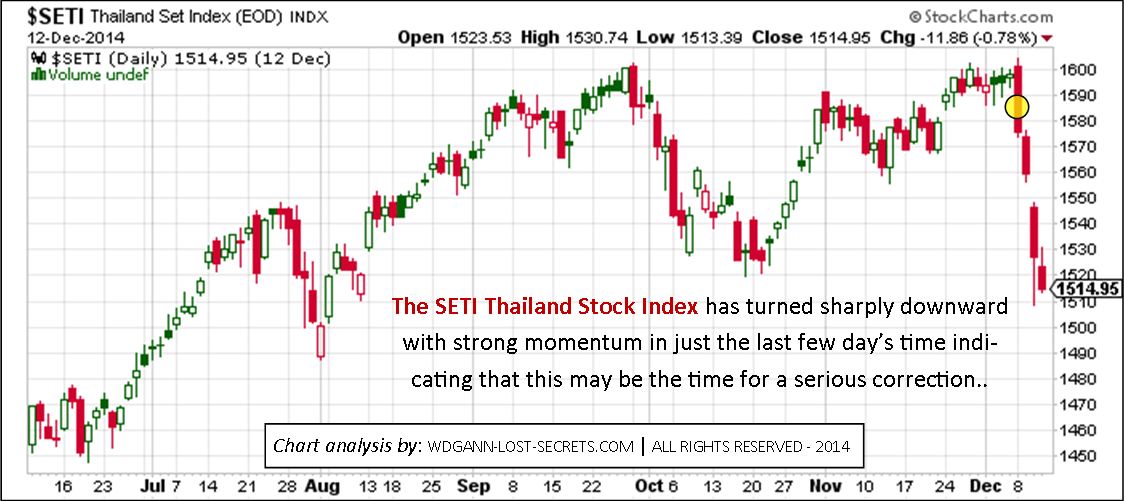

Besides Indonesia, (which has defied expectations by continuing it’s rocket ride upwards in spite of oil’s crashing prices) Thailand has been a shining light reminder of the good old days of uncomplicated bull market price movements.

It has enjoyed a beautiful, strong upwards, non-volatile bull market move all this year (until recently).

Alas, that sand-in-the-gearworks I wrote of earlier has begun to make itself visible in the Thai market now. When you look at the chart, you can almost hear the grinding and slowing down of the ‘gears’ to this index. If you listen closely enough, you may find that they have stopped and are starting to reverse a little.

The Thai stock index has also been strong and managed to hold off the beginnings of faltering for an additional quarter past when the initial shifts were beginning to show in Hong Kong, Malaysia and Singapore.

However, it may be time for this market to ‘catch up’ and the last few days seem to indicate that that’s what’s happening.

Behind all of these market gyrations is the effect of the US DOLLAR and the weakening of so many currencies against it. We’ll examine this more closely in the next article as space is limited here. – George

© 2014 Copyright George R Harrison – All Rights Reserved

george@money-tigers.com

Disclaimer: All articles and posts are a matter of opinion (drawn from over 44-years of market research & experience) and are provided for general information purposes only and are not intended as investment advice. Information and analysis above are derived from sources and utilize privately discovered methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisers.

—————————————————————————————-

Bio: George R. Harrison’s background includes time as a Hedge Fund assistant manager; an intensely focused 44-year long period as a researcher of the Markets, a Master Market Analyst & Chartist.

George has been recognized by Gann-trained clients from around the world as a uniquely qualified, modern-day WD Gann expert, (having rediscovered and restored-to-print many ‘lost’ Gann techniques through his decades of research work) and creator of several revolutionary market analytical techniques and tools.

Mr. Harrison continues his market research & private client consultation and instructional work while living on the island of St. Croix in the US Virgin Islands.

Current market comments and archived articles may also be found on his website at www.wdgann-lost-secrets.com.

George may be contacted by e-mail at: george@money-tigers.com

The Weight of Time as Trend

The Weight of Time as Trend

We’ve all felt it. The ‘weight’ of time acting as Trends in the markets.

We’ve all felt it. The ‘weight’ of time acting as Trends in the markets.

Trends that hold longer than expected and whose change in direction appears when we least expect or believe it.

Once time accumulates for an action and establishes a Trend, those trends take a lot of work to change.

It seems like the more time that passes after a task is done and energy has been spent, the harder it is to go back to revisit those tasks again.

It’s like getting motivated to mow the lawn after we’ve done it recently.

It’s easy to think about doing it again a day, 2 even 3-days after doing it, but, come a week or two later, and the ‘weight’ of time comes into the picture making the effort harder and harder to accomplish.

This is a natural function of Life AND Markets.

It takes an expenditure of energy to set things in motion and even more energy to alter or change that motion to another direction.

Markets too, once they’ve obtained the energy and motion (for a trend) tend to stay in that trend and energy flow.

An object (the Market) in motion (trending) tending to stay in Motion (in the same trend direction).

Let’s take a look at a popular market (Gold) to illustrate the point.

The chart below shows the still-continuing downward trend for Gold at present.

Gold prices have been in a declining trend for over 3-years now. Those 3-years have now accumulated a momentum of their own and ‘lent’ it to the market called ‘Gold’ and, that downtrend doesn’t want to alter it’s direction and is highly resistant to change at this point.

This principle is simply a law of Nature; one we shouldn’t fight. It takes a good deal of ‘energy’ or ‘money’ to alter a trend in motion.

The chart for GOLD above shows just such a trend in progress. In this case, Gold prices have been dropping for 3 years now.

This is a solid trend with the strong Weight of Time behind it.

It will take a great deal of energy to turn this market around. Much like it takes a great deal of time and distance to turn around an oil tanker once it’s in motion and decides to change course. Energy (money, in this case and a great deal of it) will be required to effect the change everyone has been talking about for the last 3 years while waiting for this trend to change.

A MAJOR TREND SHIFT IN GOLD?

NOT YET. But, we’re now seeing the earliest signs of some energy input into changing the trend from downwards to up again. In other words, a gradual shift towards an upwards trend has begun.

These are not at a 3-year level of trend momentum however.

The shorter downward trend periods of 6-months and 1-year have now been broken clearing the way to higher prices again.

But, these higher prices may be of short duration such as 3 to 6 months or less unless sufficient buying power comes into the market to lift prices above $1450/oz. within a month, or $1375/oz. in 6-months. Unless this happens we’re still stuck in a 3-Year downtrend that hasn’t quit yet.

A serious Bull market in Gold is not the way to bet until these price points are surpassed strongly.

In a deflationary world environment, rising prices for a commodity like Gold are pretty hard to justify or even hope for. However, ‘hope springs eternal’ in the minds of investors and traders.

I’ve written on this subject before from several different perspectives to illustrate the same fundamental laws.

When everyone has a ‘precious’ metal, it ceases to be ‘precious’ by definition. When practically everyone has something (like Gold or Silver) where is the demand going to come from to push prices higher? Anyone??

Instead of a trading plan built on wisps of hope (or hurricanes of hype), It’s far better to work within the natural cycles of trend momentum that markets and prices gravitate to in order to read the ‘signs’ that really matter.

What’s encouraged, in other words, is a Human approach to trading that works within the same rule base that the Markets must work within.

Something that gives the user a feeling of control and solid-ground to stand on because they KNOW that they’re using the very same laws that Nature uses to run the World.

There’s nothing as comforting as using analytical methods based on the Universe’s Billions of years of successful application of Natural Laws!

When we recognize that these laws of the Universe are the same laws that govern our lives and that we’re not, in any way, ‘outside’ this System, then we can voluntarily align ourselves with them and make better assessments of market conditions and timing for trading those markets.

Whether a king of manipulators or an everyday trader, we’re all playing in the same sandbox. The Sandbox (the Universe) frames and contains all our possible actions within it’s boundaries and no one can thwart it or escape the Rules of the Sandbox.

What about the massive market manipulation of our times? It turns out that this is nothing new historically and many have prospered during the many other times just like these.

Take comfort and look at it this way; At least the Laws of the Universe are Honest and Incorruptible in their equal application.

In fact, in today’s world, it’s now much safer (and more satisfying) to work within those Universal Rules in order to out-maneuver the man-made schemes and misinformation that are increasingly present in both the markets and their supporting media.

All change is difficult to both accept and act upon. Human Beings are often slow to respond, change their positions or their minds (that’s the Weight of Time coming into play). But, when the Master System that rules this Universe puts these changes of trend into effect, we have no choice but to both accept and act quickly and follow that new Trend. – George

© 2014 Copyright George R Harrison – All Rights Reserved

Disclaimer: All articles and posts are a matter of opinion (drawn from over 44-years of market research & experience) and are provided for general information purposes only and are not intended as investment advice. Information and analysis above are derived from sources and utilize privately discovered methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisers.

MORE ARTICLES ABOUT WD GANN:

- New: Gann’s Trading Rules

- Seasons of the Markets

- WD Gann’s Key to Better Market Timing

- WD Gann Lost Secrets Rediscovered

- WD Gann’s Data List Secrets

- The Wisdom of Solomon & ‘The Solomon Clue’

- WD GANN: Going Beyond Astrology

- Proper understanding and placement of WD Gann’s critical price angles.

- Secrets to WD Gann’s greatest public trade (1909 September Wheat)

- WD Gann’s Law of Vibration

- Gann’s Lost Swing Chart Technique; WD Gann’s Data List Secrets

- Many more unique WD Gann Articles: HERE.

- WD Gann’s personal hidden chart key

- Gann’s secret counting sequence to predict monthly turns

- Rediscovering the secrets to Gann’s vertical & horizontal angles

The rediscovery of these WD Gann lost secrets (and many more) as well as other completely original discoveries are available to a limited number of students each year through The Harrison-Gann Trade Secrets Master Course. Contact me by e-mail for price and availability by clicking the box below.

NOTE: This is the time of the year when I offer incredible savings to those students who wish to start the new year fresh using this extremely effective and limited-access market analysis information. Many wait all year for this opportunity!

A FUNDAMENTAL LAW OF THE UNIVERSE: You Must Take Action to Reach Your Goals. To Get the Best Deal, You Must Be Willing to Ask for the Best Deal.

Crude Oil: Strategy vs. Panic

CRUDE OIL PRICE DROP: STRATEGY VS. PANIC

Once again the headlines trumpet panic and confusion globally.

Those headlines, as I’ve stated often here, are designed to keep one OUT of the markets by creating confusion and delay (using ‘logical’ arguments as the anti-investor ‘tool’ of choice).

Moments like those that occurred on Friday, (when approached strategically) offer early warning of what’s-to-come when it comes to price movements.

Crude Oil is a 24-hour global market of significance. KNOWING what’s happening internally with it’s price structure is a critical factor in seizing profit opportunities.

Let’s apply one of our trading analysis tools (The Excalibur Method) to Friday’s price action to show the hypothetical results one might have realized using this approach as our intra-day strategy.

PS: THE ONCE-A-YEAR HOLIDAY SPECIAL OFFER

PS: THE ONCE-A-YEAR HOLIDAY SPECIAL OFFER

Today’s and yesterday’s examples of Friday’s price moves are the type of moves that can go a long way towards recovering funds lost while trading without such an effective methodology as The Excalibur Method.

‘Tis the Season” to take a real holiday from market confusion and start taking control or your own trading destiny?

ACT TODAY.

CLICK HERE and drop me a line for your special offer for the Excalibur Method or to acquire the Harrison-Gann Trade Secrets Master Course (available module by module or all-at-once.

Please note that I can only process just so many orders in the coming days & weeks and the special price will be withdrawn at the end of this time period. So, get to the head of the line by ordering today. A year is a long time to wait for these special prices to come around again!!

The Excalibur Method & Friday’s GOLD Break

THE EXCALIBUR METHOD & FRIDAY’S GOLD MOVE

As we’re now moving into the last month of the year, we’re also in a very special period of the year.

You’ve Waited All Year For This! DON’T MISS OUT!

This has been the time when I offer those who have been waiting all year to purchase some of the educational materials we offer here the very best price of the year. This includes the Excalibur Method which we’re highlighting here in today’s post (as in so many posts over the past 4 years time on this website).

Those who had purchased the Excalibur Method would have been able to watch GOLD this last Friday as it subtly shifted it’s trend and using Excalibur, could have hypothetically nailed the very beginning of the turn downward in price (*See the Chart for Hypothetical Trade):

This GOLD trade alone was potentially worth thousands of dollars.

Market opportunities like these will abound over the next weeks and months.

And, these are the type of moves that can go a long way towards recovering funds lost while trading without such an effective methodology as The Excalibur Method.

Are you ready to take a real holiday from market confusion and start taking control or your own trading destiny?

ACT TODAY.

CLICK HERE and drop me a line for your special offer for the Excalibur Method or to acquire the Harrison-Gann Trade Secrets Master Course (available module by module or all-at-once.

Please note that I can only process just so many orders in the coming weeks and the special price will be withdrawn at the end of this time period. So, get to the head of the line by ordering today.

Thank you for your continued interest in our methods and courses over this last year (and previous years). I wish you the very best in the New Year ahead and hope that you’ll be sailing in more prosperous market ‘waters’.

Our mission here is to help you in attaining just that goal with the very best analytical tools available anywhere and ONLY FROM THIS SOURCE. – George